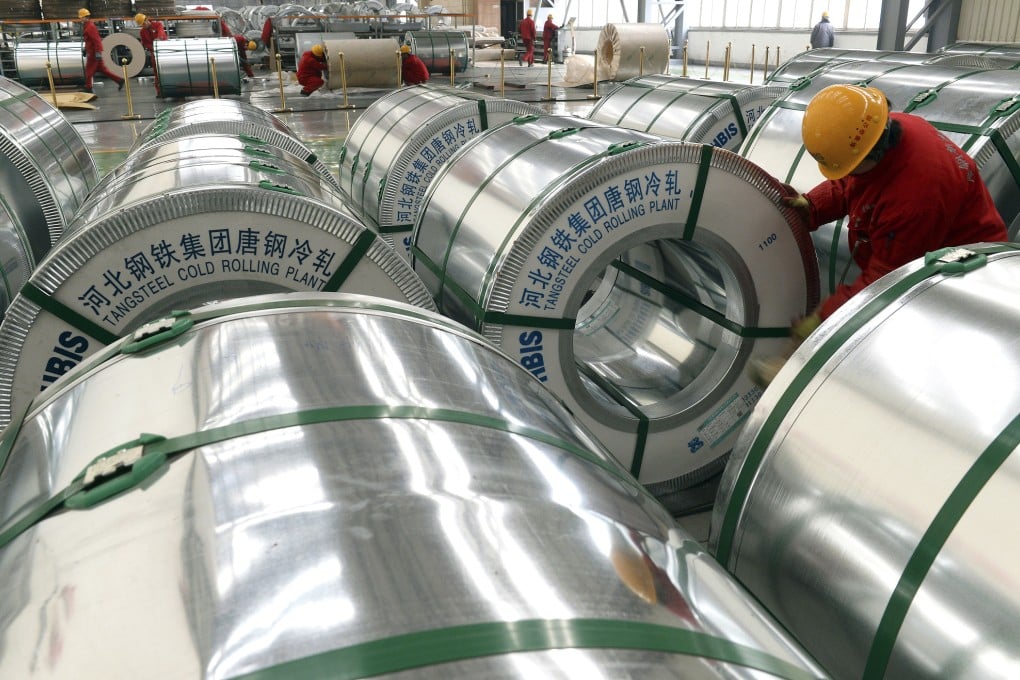

Debate in US over trade deficit with China heats up

Trade gap with China brings demands for action, though some warn measures could be counterproductive as jobs are being created

A chorus of voices in the United States has been calling for tougher trade action against China, alleging imports from the country are slashing jobs in the US.

China is the second-biggest trading partner of the US, behind Canada, and the US was the largest trading partner of China last year, according to official data.

Recent academic research shows the growth of Chinese exports to the US had resulted in job losses in the US, Larry Qiu Dongxiao, an economics professor at the University of Hong Kong, told the South China Morning Post.

"However, China is not the only country to be blamed," Qiu said. "The international production structure is responsible for this."

Many countries, including Japan, export intermediate goods to China for assembly, and the final goods are shipped from China to the US, Qiu said.