Brands must revise strategies to keep up with savvy Chinese customers

Brands must revise their strategy in the mainland to emphasise online shopping and stay in line with fast-changing trends

This year, brands selling into the Chinese market will increasingly be facing a new consumer dynamic. For the past decade, brand success was predicated in large part on the aggressive education of consumers and on presenting them with products that they had previously not had the funds or access to buy. But following a decade of strong retail growth, brands are now waking up to a retail environment in the mainland that still has a tremendous upside, but one that is significantly more challenging than before.

To be successful over the next three to five years, brands must focus more on their unique value proposition and on differentiating their products and retail experience to match the needs of consumers who are increasingly brand savvy, more cautious about their spending growth, and more demanding in their expectations of what they will get for their money.

China’s economy is expected to grow at a rate of close to 7 per cent - while this is nothing to sneeze at, it is still significantly below what it has been over the past 20 years. The end result of this slowdown in growth is that while Chinese consumers are still seeing their economic situations improve, the middle class is becoming less convinced that they will see the rapid wealth growth they have seen in the past and adjusting their buying behaviour accordingly. Rather than buying products purely for status, they are instead looking at value in terms of how easy it is for them to buy and whether or not products are fresh and different.

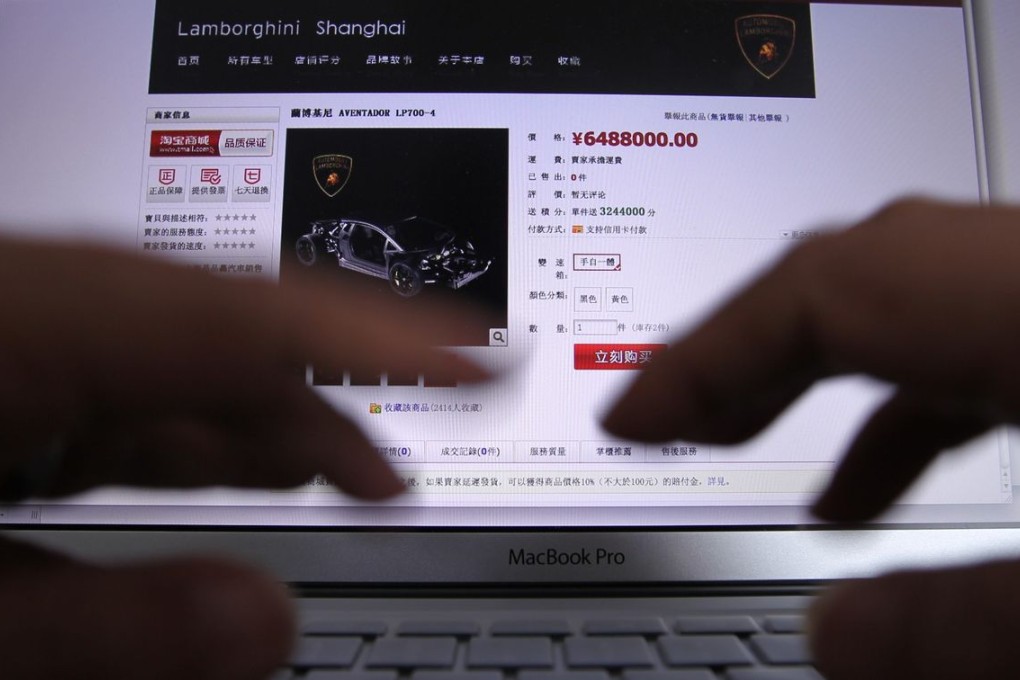

A successful retail strategy in China this year means having a robust e-commerce presence, and this means having a strong mobile presence. The mainland now has more than 700 million smartphone users, and more so than in any other country, Chinese online shoppers are accessing stores and making purchases via mobile devices. As China has developed and becoming increasingly connected to the internet, the bulk of growth has come via mobile devices. In contrast to the US, where most shoppers born after 1985 first accessed the internet via a desktop or laptop computer, in China the vast majority were first connected by phone, so they are more apt to seek access to websites and stores via mobile devices.