Hong Kong needs more innovative and automated solutions on top of government incentives to help its under-utilised, money-losing sustainability efforts.

The Chinese stock market is poised to see the emergence of shareholder resolutions on ESG issues next year, as incoming corporate governance reforms start allowing many more minority owners to present proposals for voting, a stewardship expert says.

Climate mitigation and adaptation projects that ‘stand on their own’ appeal to more mainstream investors, one financier says, especially after controversies that dented confidence in voluntary carbon credits.

EnerVenue, a rechargeable batteries start-up co-founded by the family office of tycoon Peter Lee Ka-kit, aims to build factories in the US and China to commercialise an old technology deployed in outer space for use on Earth.

Avant Meats is expanding its lab-grown seafood production capacity amid growing popularity of sustainable seafood.

The nation’s largest oil and gas producer says it is on track to peak carbon emissions next year and double the contribution of low-carbon energy to its output capacity over two years, top leaders say.

Government plans to establish a clear pathway on sustainability reporting for businesses in Hong Kong this year, a move that is ‘essential’ to ‘reinforcing Hong Kong’s leading position on the international sustainable-finance map’, says financial services secretary.

The city needs to set financing volume targets, restrict fossil fuel financing and enact a specialised anti-greenwashing law, environmental group says.

With the world facing a US$4 trillion green investment gap a year, transition finance will grow in importance because of regulatory support in Asia, experts say.

Towngas, which last raised its basic tariff by 4.4 per cent in August 2022, is under pressure to lift gas tariffs this year ‘as we need to invest further in our network infrastructure’, managing director Peter Wong says.

More than 200 greentech companies currently operate in the city, of which some are equipped with ‘globally competitive’ technologies and are making inroads into the mainland Chinese and overseas markets.

The government should further open the local environment-protection market to attract investment from Greater Bay Area companies, says a vice-president at the Hong Kong-listed company.

CLP will source more nuclear energy from China’s Guangdong province to feed its power grid and sees business opportunities in decarbonisation as it phases out coal-based assets.

Start-up H2 Solution is planning to set up its operations at Hong Kong’s science and technology park in Pak Shek Kok as a launchpad into overseas markets.

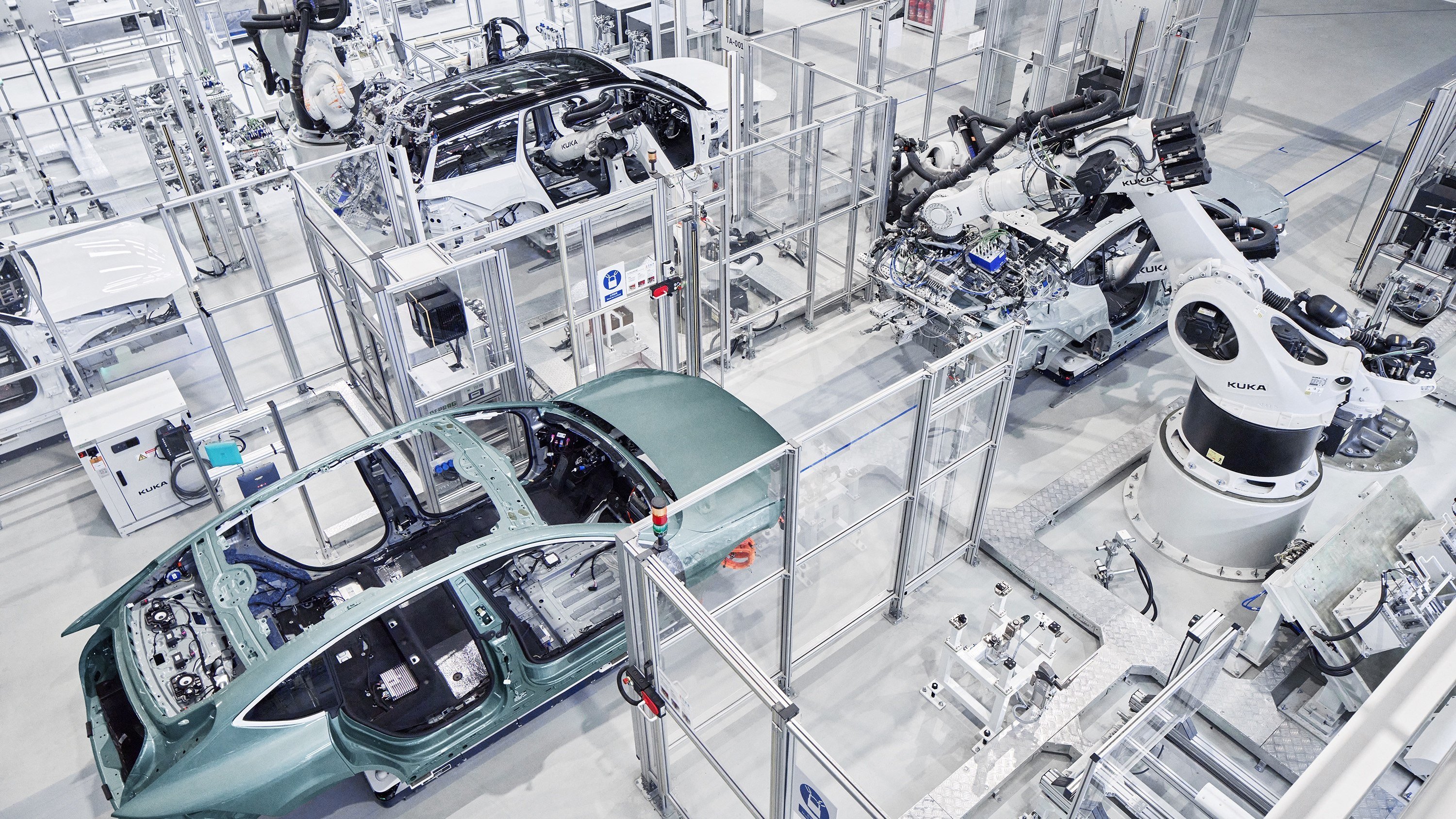

China’s global dominance in the production of three key energy transition products – electric vehicles, batteries and solar panels – will face more challenges this year from industry overcapacity, price wars and trade barriers, French bank Natixis says.

GRST, the Hong Kong green technology start-up which won Prince William’s Earthshot Prize, is in talks to deploy its eco-friendly batteries in a range of electrical applications, COO Karen Ng says.

Hong Kong’s recycling pace lags that in Europe and the US, but government intervention could help transform the landscape as growing landfills contaminate the soil.

Banks need to adopt more forward-looking and long-term metrics on risk-return assessments to meet growing climate financing needs, according to top bankers at the Climate Business Forum.

Hong Kong launched a week-long series of sustainability-themed discussions, exhibitions and events as the city pushes its plan to transform itself into a centre for both green technology and green finance solutions.

China is at risk of missing its climate targets and suffering major economic losses unless it takes decisive actions to put a halt to runaway coal power plant expansion and reform outdated power grid management, says Centre for Research on Energy and Clean Air.

GGSN, which is partly owned by New World Group, is in talks to set up research, product development and marketing facilities in Hong Kong, where it hopes to demonstrate its autonomous charging devices in the car parks of offices and malls.

‘Hong Kong has three strengths that are indispensable for fostering climate financing: technical, legal and financial knowledge,’ says Riccardo Puliti, IFC regional vice-president.

Investment products where security selection is based on companies’ ESG scores outperform in the long term, data has shown.

China’s dairy industry has stepped up its automation and innovation drive, and food packaging and equipment maker Tetra Pak is helping in these efforts which seek to cut production costs, through reduced wastage and water usage, while tempering greenhouse gas emissions as well.

Under the EU Carbon Border Adjustment Mechanism a tax of 6 per cent will be levied on steel in 2026, which will rise to as much as 21 per cent in 2034, Goldman estimates. It is part of the EU’s plan to level the field for domestic producers.

EU regulations and laws aimed at achieving the region’s 2050 net zero ambition ‘can be considered a kind of protectionism’ and have major implications for Chinese firms, says TUV Rheinland technical manager.

Exporters of certain carbon-intensive products have six more months to set up systems to collect, calculate and report emissions data, and their exports are likely to face import duties starting in 2026.

Hong Kong will play host to a green and sustainable finance training event in June for several hundred policymakers, regulators and finance professionals in dozens of developing nations.

The two producers of the metal that powers EV batteries expect 2023 net profit to decline by as much as 80 per cent.