While Asia’s property markets have no shortage of stories, some of the most consequential are also among the most overlooked by investors. The strength of Seoul’s office market, more affordable luxury residential property and Japanese investment in Australian property all merit greater attention.

While China’s downturn tops the list of risks in developing economies, less attention is paid to the difficulties in sustaining India’s boom. Yet India’s weaknesses, such as a low labour participation rate, a lack of jobs and a large fiscal deficit, should not be overlooked.

Hong Kong’s move to scrap long-standing cooling measures in February was a breath of fresh air at a time when other markets are turning inward. The city deserves credit for adopting a contentious policy while Canada, Singapore, Australia and others are making life harder for foreign homebuyers.

In a matter of three months, amid strong US economic data and all-time S&P 500 highs, the outlook for interest rates has changed considerably. The Fed may want to see inflation quashed without triggering a recession, but the more likely scenario is rates will come down only if the economy slows sharply.

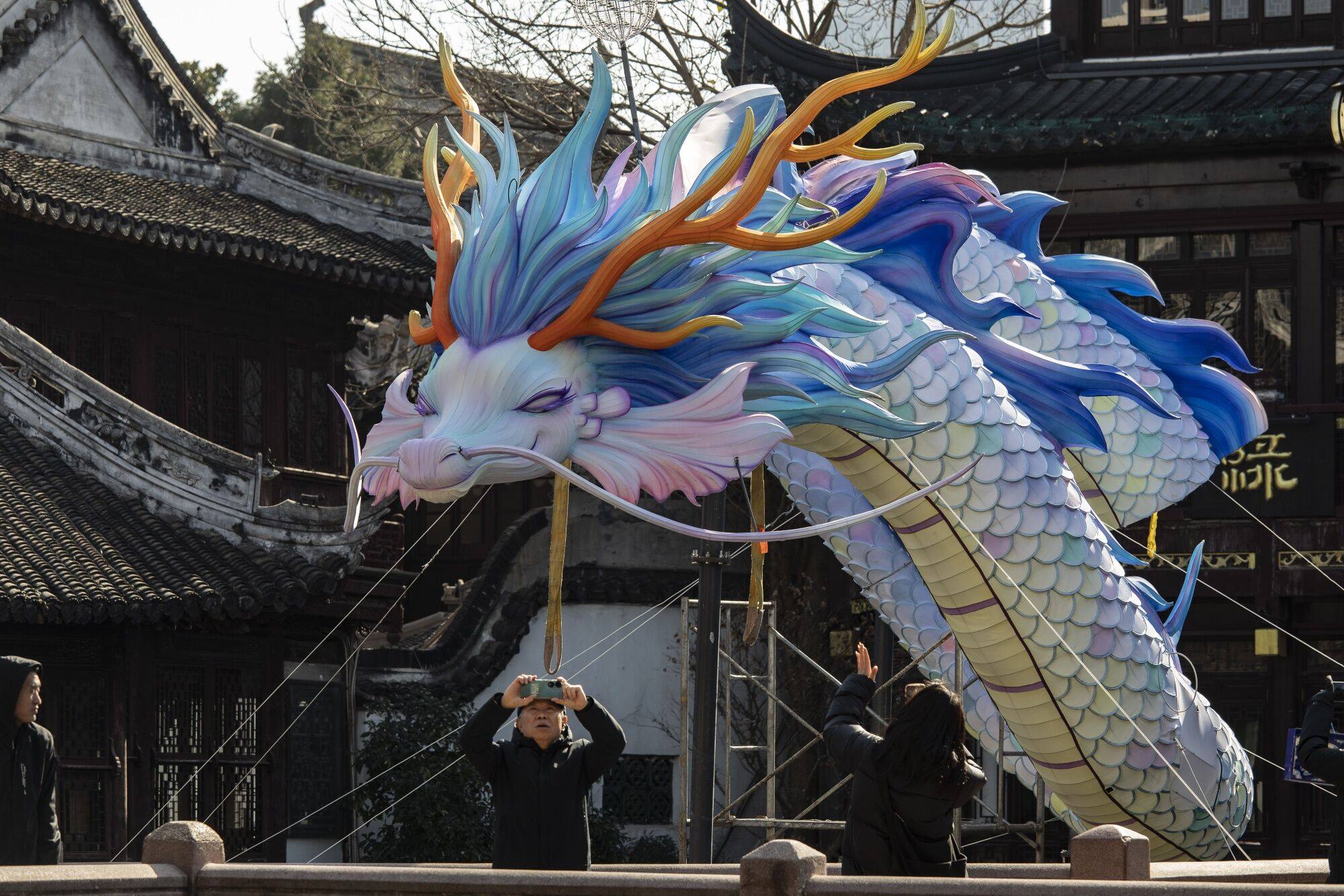

Investors banking on Chinese policymakers providing aggressive stimulus are trapped in an old view of China and its economy. The news is far from all doom and gloom, but investors need to accept that China’s economy will remain vulnerable and recovery will take time.

Planning restrictions are constraining supply in all sectors of Australia’s residential property market, driving up prices and rents, but the lack of a clear way forward on student housing threatens to hold back the potential of a sector that is increasingly important to the Australian economy.

Japan’s central bank ending its negative interest rate regime comes not a moment too soon, but that alone will not return the economy to its heyday. Uncertainty over the outlook for growth and inflation persists, and the internal issues that led to the adoption of ultra-loose policy are still in place.

Office markets in Asia are performing well and the shift to hybrid working has had less of an impact, yet investment in the sector has fallen sharply. Asia’s office markets need a stronger narrative, one that differentiates the sector more clearly from its counterparts in the US and Europe.

Bitcoin has staged a comeback from a difficult 2022, with its price rising higher than US$73,000 on the back of support from US regulators. The approval of spot bitcoin ETFs is driving interest but also raising fears of the cryptocurrency losing its status as an unregulated, decentralised product.

The end of more than a decade of cooling measures for Hong Kong’s property market is welcome and has sparked a surge in new home sales. These changes must be put in proper context, though, as several other factors will be more consequential in setting the property sector’s course.

Li Qiang admitting Beijing will have a hard time delivering on its pledge of 5 per cent GDP growth is a wild understatement given China’s economic struggles. The government’s policy response has been piecemeal, equivocal and confusing, frustrating investors and sapping confidence among domestic consumers.

Deteriorating affordability has left many Australians struggling in the housing market, but foreign buyers’ interest remains strong. Record migration, China’s housing crisis, Australia’s stability and Asian private wealth’s influence are driving the surge.

Just months after investors were convinced interest rates would come down sharply this year, expectations have been significantly reduced. The experience of Australia and New Zealand shows that when inflation remains sticky and employment holds up, there is little room for central bankers to consider rate cuts.

Given the bleak domestic and external backdrop, the strong performance of China’s commercial real estate investment market is remarkable. It shows that a solid domestic investor base, a sharper repricing of property values and policy support for key sectors can make a difference.

The Magnificent Seven’s dominance of US stocks and its outsize impact on the performance of global equity markets has amplified fears of a new tech bubble. These fears ignore that the grouping is built on sound fundamentals and is driving structural mega trends rather than being a threat to financial stability.

While Donald Trump has taken credit for the fall in Chinese stocks, the truth is that domestic, not external, factors are at play in China. Instead, the focus should be on Trump’s threat to US democracy, the rule of law and the credibility of American economic policy should he be re-elected.

Compared to markets in the US and Europe, both prices and rental yields have been slow to adjust. As a result, affordability has taken a hit and investors are thinking twice. Yet Asia’s strong underlying fundamentals are undoubtedly an asset.

Despite the gloom, there is a glaring lack of consensus about the outlook as Beijing signals more aggressive support. Critically, Wall Street banks are not ready to give up on China.

Given high borrowing costs, cooling measures and a surge in private home completions, it would be astonishing if Singapore did not see a slowdown. While the property sector is losing momentum, it is the kind of slowdown landlords and investors in most other markets would envy.

Concerns about the reliability and quality of economic figures in China are well known, but unease exists beyond Beijing. In the US, partisanship is skewing the data, so much so that it is shaping the economic narrative and exerting an influence on politics and policy.

India’s growing middle class, the right government support and a favourable external environment have given the property sector wings to escape the headwinds buffeting markets elsewhere.

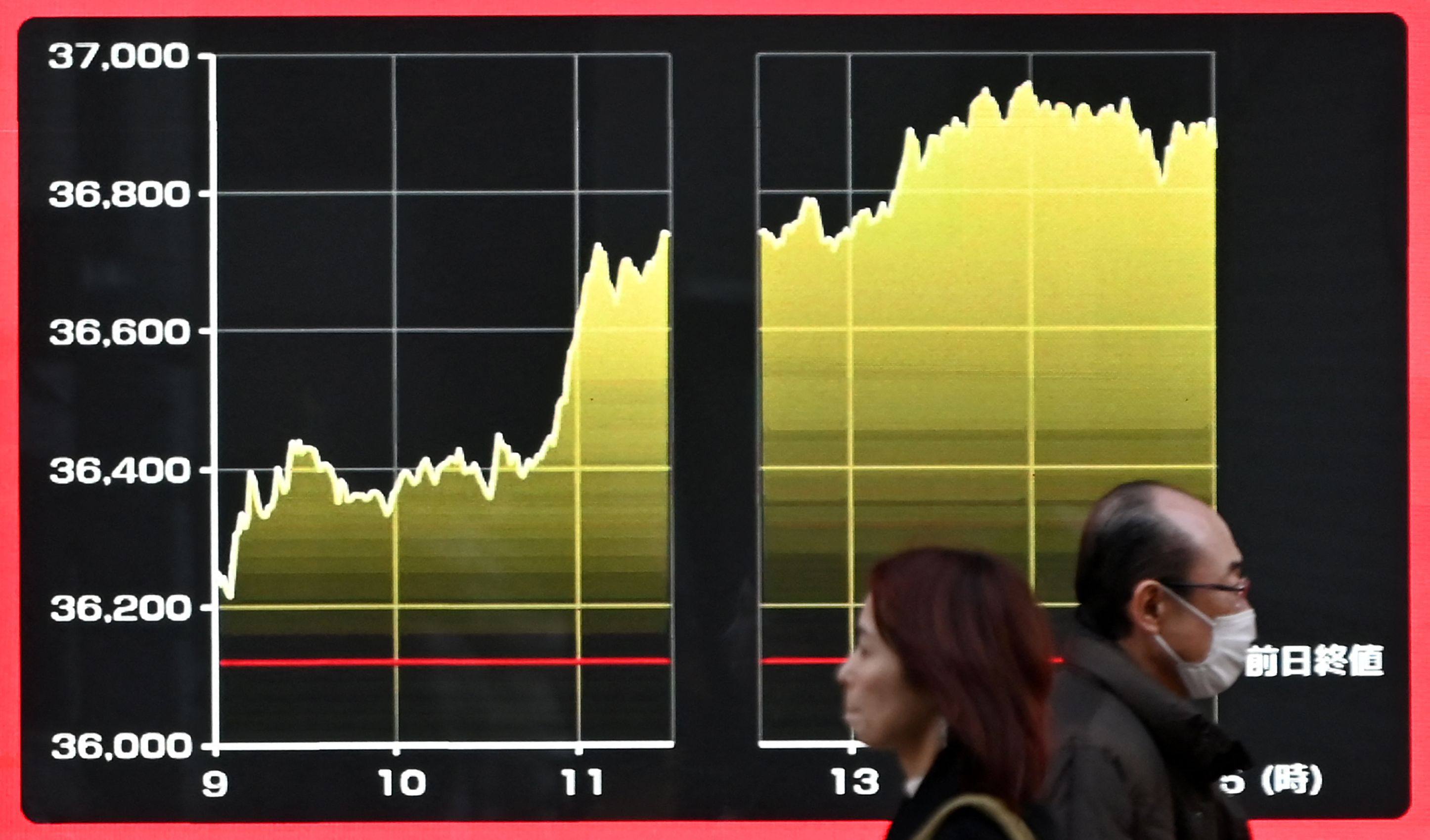

Tokyo has overtaken Shanghai to become Asia’s largest stock exchange, driven by investors keen to get exposure to the region while mitigating risks in China. However, China is an important source of revenue for Japanese firms in crucial industries, which would be hard hit by a deeper downturn in the world’s second-largest economy.

The emerging sector of multifamily properties is offering many untapped opportunities – especially in China, where catalysts for the institutionalisation of its rental housing market have coalesced in recent years.

The Fed must make the tough call on when to ease rates. Amid heightened risks of a major policy blunder, the impact of its decision on Asia – where the case for a looser policy is stronger – cannot be ignored.

The earthquake and plane collision earlier this month are unlikely to deter travellers as Japan continues to welcome record levels of tourists. The tourism rebound has aided the investment appeal of Japanese hotels, but so have loose monetary policy and a large domestic tourism market.

The 2024 electoral calendar is jam-packed as more than 4 billion people around the world will go to the polls, but one election has world-changing potential. The return of Donald Trump to the White House would be a gift to US adversaries while eviscerating its security commitments and crippling climate change efforts.

The big worries in Asian real estate from 2023 will persist this year, but sources of resilience and strength will also endure. Trends meriting close attention include Australia’s housing market, Chinese property beyond housing, an Indian real estate boom and retail property strength.

A growing number of investors in developing economies are carving China out of their portfolios, but they are merely trading one set of risks for another. Fund managers cannot ignore the influence China has over emerging markets, especially in Asia, and alternatives are not as cheap as they used to be.

The prospect of positive spillovers from mainland China’s economy stabilising and the US Federal Reserve’s dovish turn could mean a brighter 2024 for Hong Kong.

There is reason for optimism after the Federal Reserve’s surprise interest rate decision, but there are also still plenty of reasons for caution. The fact that markets are expecting the smoothest of touchdowns for the US economy next year should be ringing alarm bells.