The lure of high returns that aren't correlated to other markets has led to an explosion of global hedge fund money, to more than US$2 trillion. Unfortunately, "explosion" also describes a number of hedge funds that literally blew up over the years due to fraud or poor risk controls.

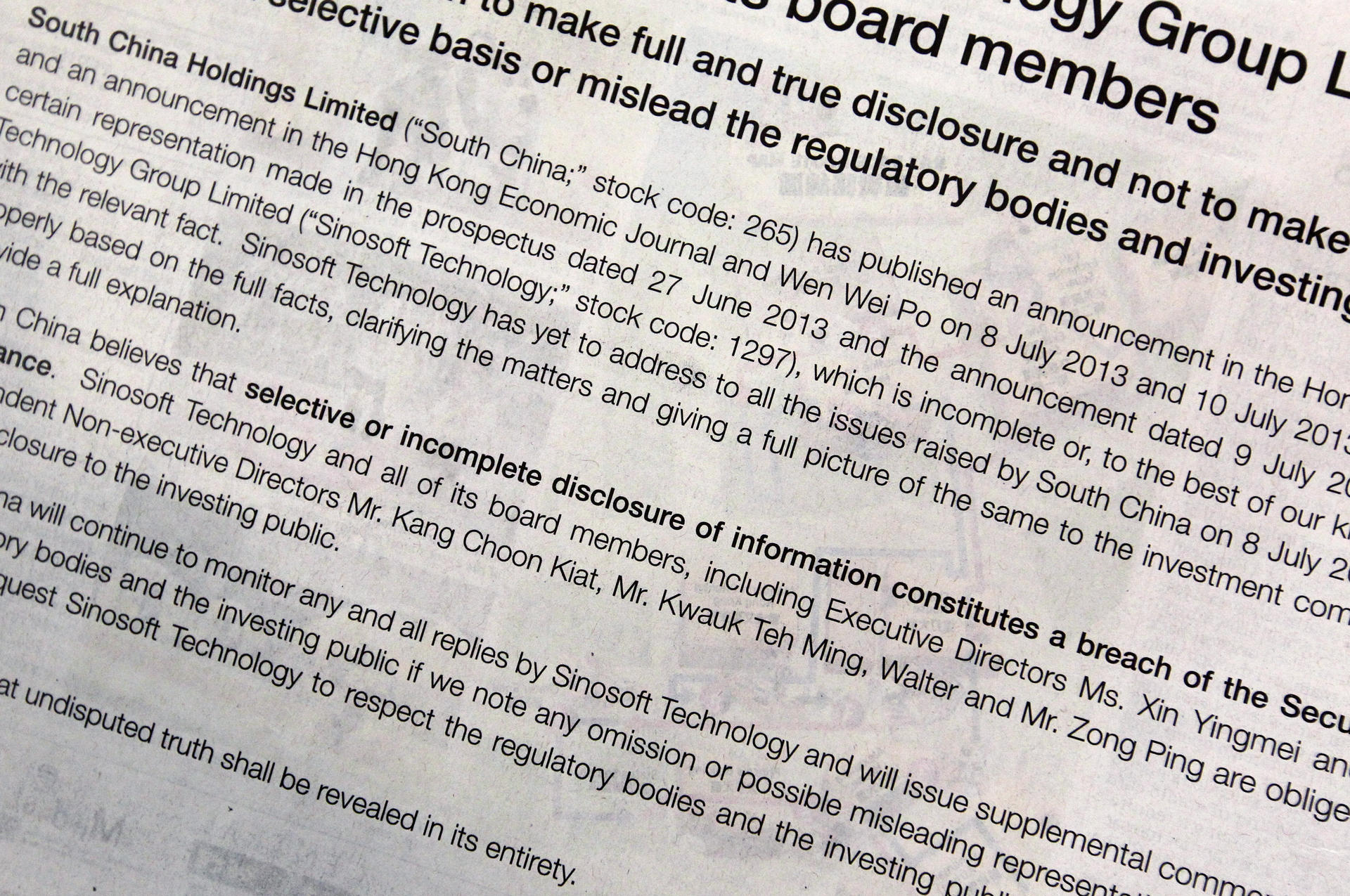

Recently, I spotted a company announcement that left me scratching my head. On July 11, a diversified holding company called South China published an open letter to Sinosoft Technology "regarding a certain representation made in a prospectus … issued by Sinosoft Technology Group which is incomplete or, to the best of our knowledge, inconsistent with the relevant fact".

I've recently advocated sticking to your investment plan even in these turbulent times. And companies that make and distribute consumer staples such as soap, shampoo and the like (think Kao, Nestle and Procter & Gamble) that are otherwise known as defensives are an obvious place to hide out during any market storm.

In his autobiography So Far So Good (written when he was aged 94), Roy Neuberger of the eponymous asset management firm mentioned 10 principles of successful investing, including this gem: "Usually, when both short-term and long-term rates start rising, they tell the stock investor one story: Run for the hills."

Most investment topics are fairly mundane affairs that might only cause eyebrows to furrow, as in "I wonder if I could make any money investing in Vietnam" or "How can I put some more money to work in emerging markets?" or "I wonder how the US market will do this year". But not the mainland.

According to National Geographic's latest weekly series The '80s, the 1980s was a decade of such importance that its cultural shifts and innovations continue to underpin everything we see today.

Given his cult-like following, critiquing Warren Buffett's investment approach takes a pinch of courage and a pound of stupidity. But that has never stopped me before … and it is a good time to look at Berkshire Hathaway, given that it held its annual general meeting earlier this month.

Walking on eggshells? Here is my Top 10 list of common blunders made by investors. 1. Letting your investment adviser act like he is managing "other people's money": This can be a dangerous attitude, particularly if your manager is rewarded on the upside (with performance fees) but has nothing to lose if your investments tank.