Monitor | China's stock regulator is clutching at straws

Beijing’s measures in favour of margin trading will destabilise the market and scare away ordinary investors as volatility takes its toll

Beijing's efforts to talk up the mainland's domestic stock market are sounding increasingly desperate.

This week the China Securities Regulatory Commission said it would relax restrictions on margin trading, allowing investors greater leeway to leverage up and buy stocks with borrowed money.

This is just the latest in a series of attempts by the regulator to boost prices. In recent months CSRC officials have repeatedly told investors that equities are a bargain, while pressing companies to buy back their own stock, even allowing managers to offset the cost by paying employees in shares.

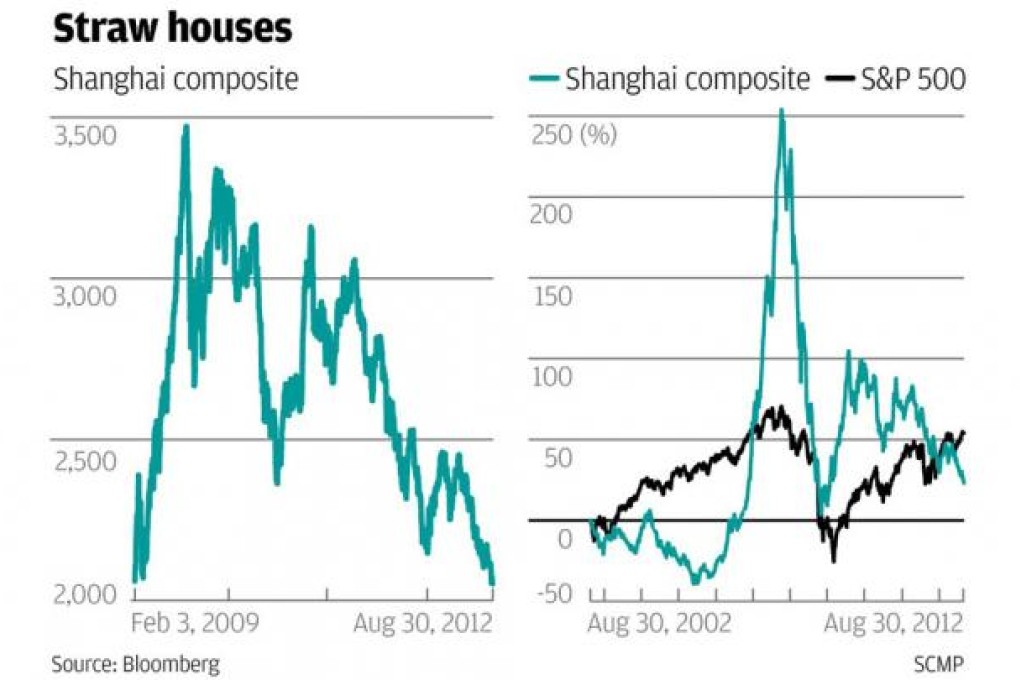

Nothing has worked. The benchmark Shanghai Composite Index has slumped 20 per cent over the last year, closing yesterday at its weakest level since the depths of the financial crisis in February 2009 (see the first chart).

In response, the regulator has decided to ramp up margin trading. Until now, brokers have only been allowed to lend to clients from their own cash holdings. Under the new rules, however, brokerage houses will be able to borrow money from other financial institutions in order to fund loans to their customers.

You can imagine why someone thought this might be a good idea. According to the official China Securities Journal, the new margin facility will inject some 120 billion yuan (HK$146.8 billion) of fresh liquidity into the ailing market.