Monitor | Rail freight and electricity data can be misleading

Li Keqiang’s two favourite indicators give a deceptive picture of the mainland’s slowdown

I blame Li Keqiang.

When he was party boss of Liaoning province, the favourite to succeed Wen Jiabao as premier said he didn't trust official economic data.

The figures for gross domestic product, he dismissed as "man-made".

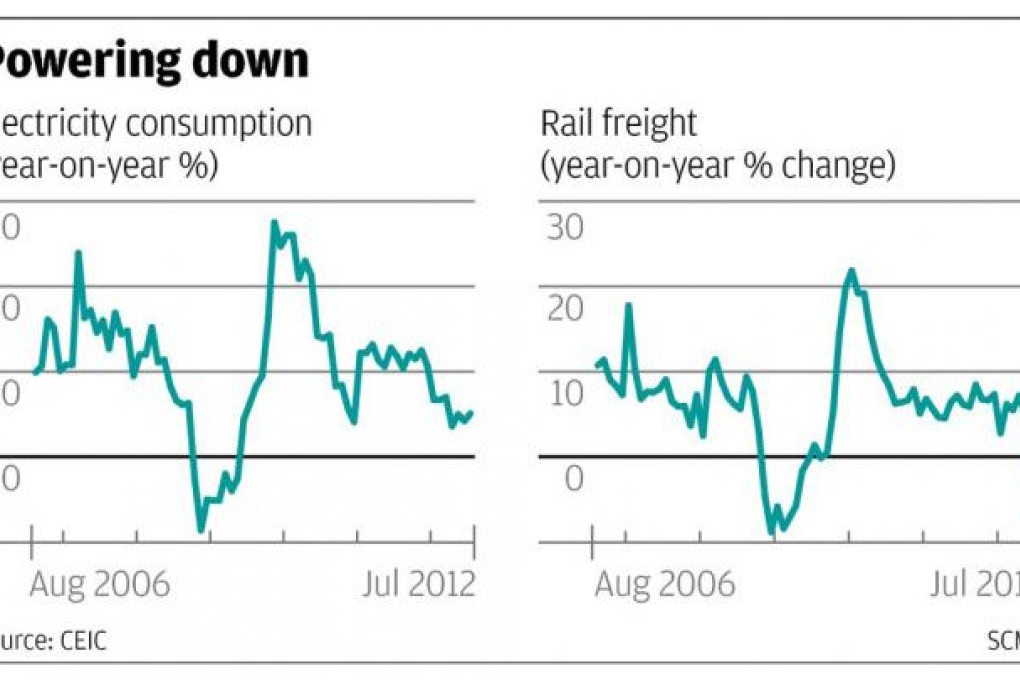

To get a more accurate picture of what was going on in his province, he said he preferred to look at real world indicators, including electricity consumption and rail freight volumes.

Ever since, analysts have been poring over the amount of electricity the mainland uses each month and the tonnage of cargo shifted on the country's railways in an attempt to work out how fast the world's second-largest economy is really growing.

Lately they have found a lot to worry about.