Monitor | Excluding non-locals from flat sales could easily backfire

Move threatens to bring a triple-whammy to muddy eventual downturn, turning what would have been a healthy correction into a rout

Here's a trivia question: what do China, Taiwan, Singapore, Korea, the Philippines and almost everywhere else in Asia all have but Hong Kong doesn't?

You can probably think of lots of things, but in this case the answer is restrictions on property purchases by foreigners.

Now property analysts at brokerage house CLSA are arguing that Hong Kong should slap controls on non-resident buyers in a bid to moderate the city's property cycle.

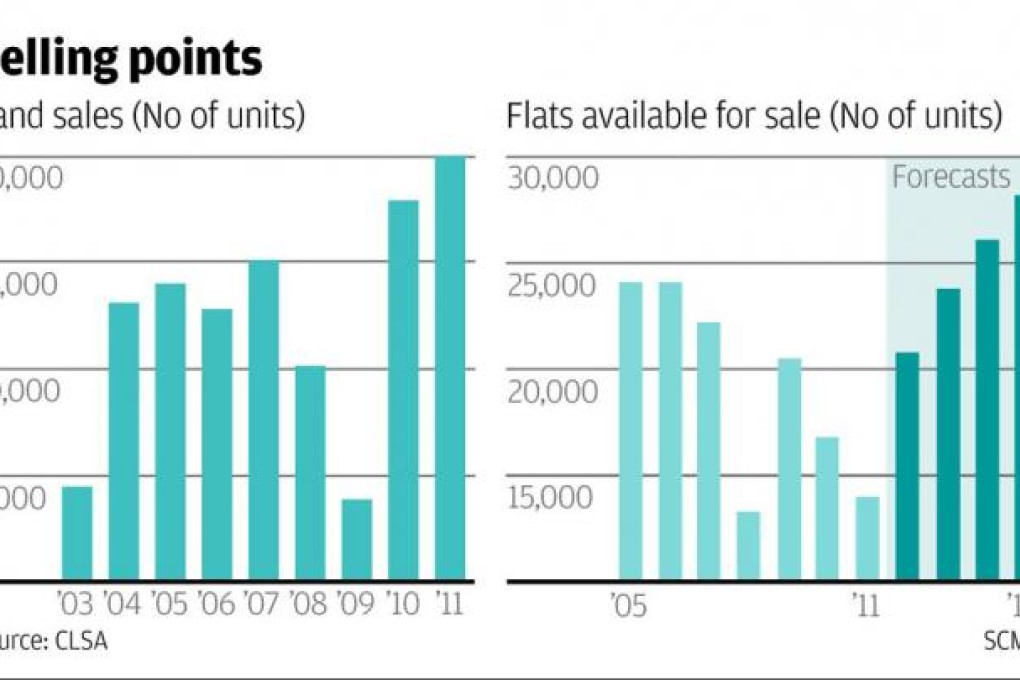

In a new research report styled as an open letter to Chief Executive Leung Chun-ying, CLSA head of property research Nicole Wong and her colleagues note that between 2004 and 2009, land sales in the city declined by 70 per cent.

Allowing a two-year time lag for development, they go on to point out that over the corresponding period between 2006 and 2011, the city's economy grew by 29 per cent, while the number of middle income families earning more than HK$40,000 a month shot up by 52 per cent.

As a result, Hong Kongers' demand for new homes shot up just as the supply was evaporating.