Monitor | What 'pivot'? Real US-China war will be over money

Any default on America's debts will result in an overhaul of the financial system and leave the biggest creditor writing the rules to suit itself

Anyone who fears that Washington's "pivot" towards the Pacific increases the risk of conflict between the United States and China is behind the times.

America and China are already at war. Only the battle ground isn't the East China Sea. It's money.

In his latest book Paper Promises author and Economist columnist Philip Coggan describes economic history as an endless struggle between borrowers and lenders over the irreconcilable difference in their interests.

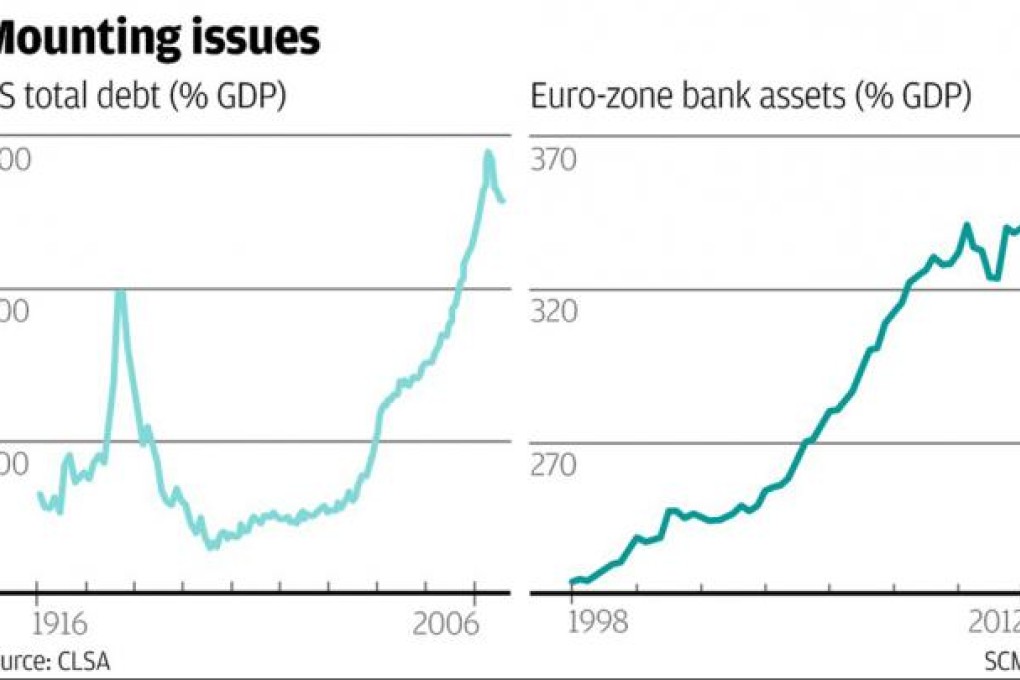

Today that difference pitches the US, as the world's largest debtor, into conflict with China, the planet's biggest creditor.

Coggan explains that creditors are always trying to defend the soundness of money as a store of value, in order to ensure they get paid what they are owed.

Debtors, on the other hand, have a powerful incentive to debase the value of money, which effectively lets them off the repayment hook.