Monitor | The real extent of China's economic hard landing

A look at the figures shows the mainland is paying the price for having severe industrial overcapacity amid suppressed domestic demand

The cynical explanation for the rash of anti-Japanese demonstrations that spread across China this week is that Beijing encouraged the protests, or at least allowed them to go ahead, in order to take people's minds off what is going on at home.

And what is going on at home is not just an unseemly power struggle ahead of the approaching leadership transition, but an uncomfortably hard landing in China's domestic economy.

Behind China's slowdown lies the enormous investment boom of the last few years.

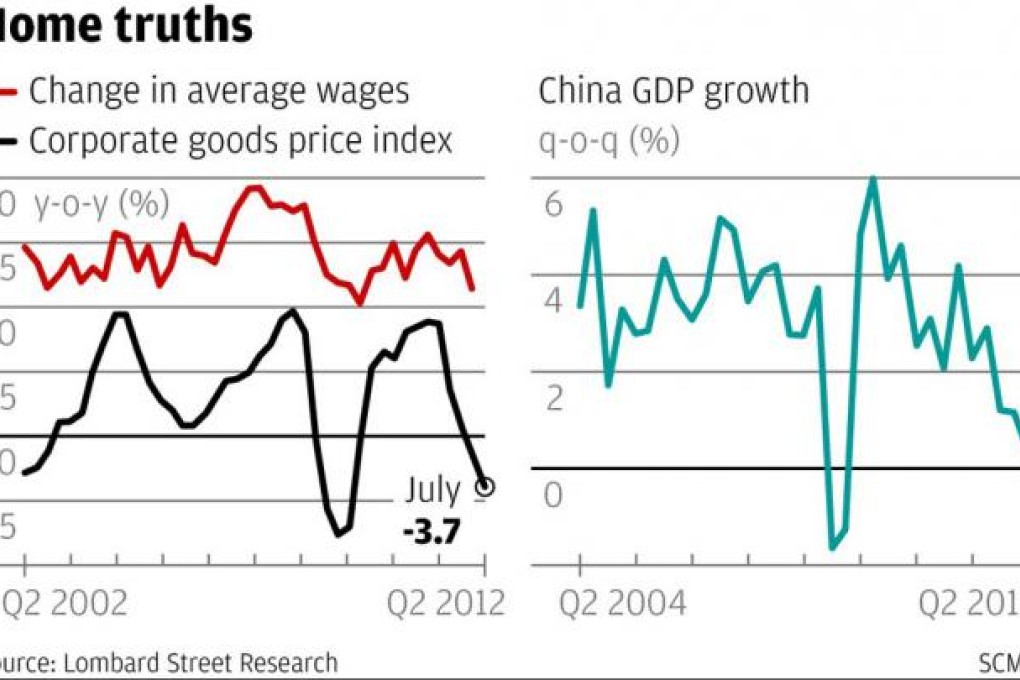

On one hand, headlong investment has created severe overcapacity in a swathe of industries, overcapacity that is now weighing on prices.

On the other hand, government efforts to rein in runaway property prices have suppressed domestic demand.

The result of this simultaneous supply glut and demand deficit has been an abrupt swing from rising prices to deflation.