Monitor | China's 'new normal' growth is still far too optimistic

Investment-fuelled economy has its limits and even shift to consumption as economic driver won't deliver big results, if precedent is any guide

Everyone is talking about "the new normal" in Chinese growth.

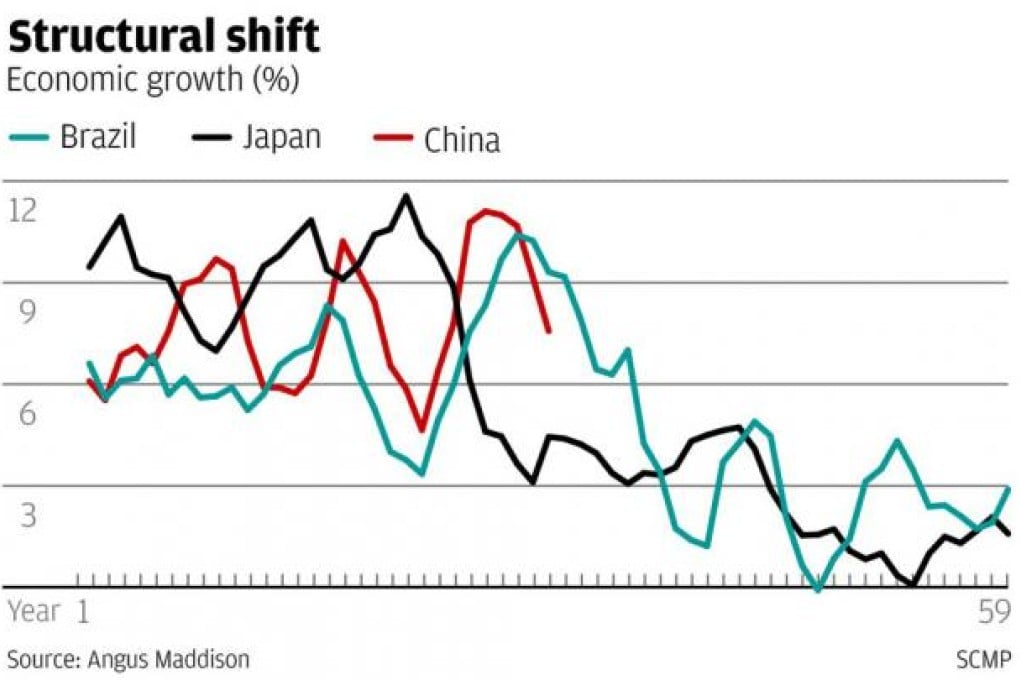

What they mean by this is that the softening we are seeing now in China's economy is not just a cyclical dip, but a structural down-shift to a slower growth path.

As the World Bank's former mission chief in Beijing, Pieter Bottelier, put it back in back in July: "The heady days of double-digit economic growth in China are almost certainly over."

Plenty of other economists agree. In its latest economic outlook released today, the International Monetary Fund forecasts that China's economy will slow to just 7.8 per cent this year and 8.2 per cent next year, compared with an average growth rate of 10.6 per cent over the last 10 years.

A slowdown has long been expected. In recent years, China's growth has been propelled overwhelmingly by investment, which in 2011 made up nearly half of the country's gross domestic product.