Monitor | Yes, the HK$ peg is to blame, but the alternatives are worse

Cheap money is behind high property prices but any moves to fully float or manage the currency like Singapore do have their pitfalls

Property prices are an eternal obsession with Hong Kong's inhabitants.

Even so, Monday's Monitor column examining some of the reasons why we can expect the home prices to continue setting new records broke new ground.

Among the responses it elicited from readers was one tightly reasoned e-mail from a prominent local financier which ran to more than twice the word count of the original article.

In a nutshell, our reader argues that increasing the supply of housing will do nothing to bring down prices. With mortgage rates as low as 2 to 3 per cent, building more flats will simply encourage more buyers to invest in the property market.

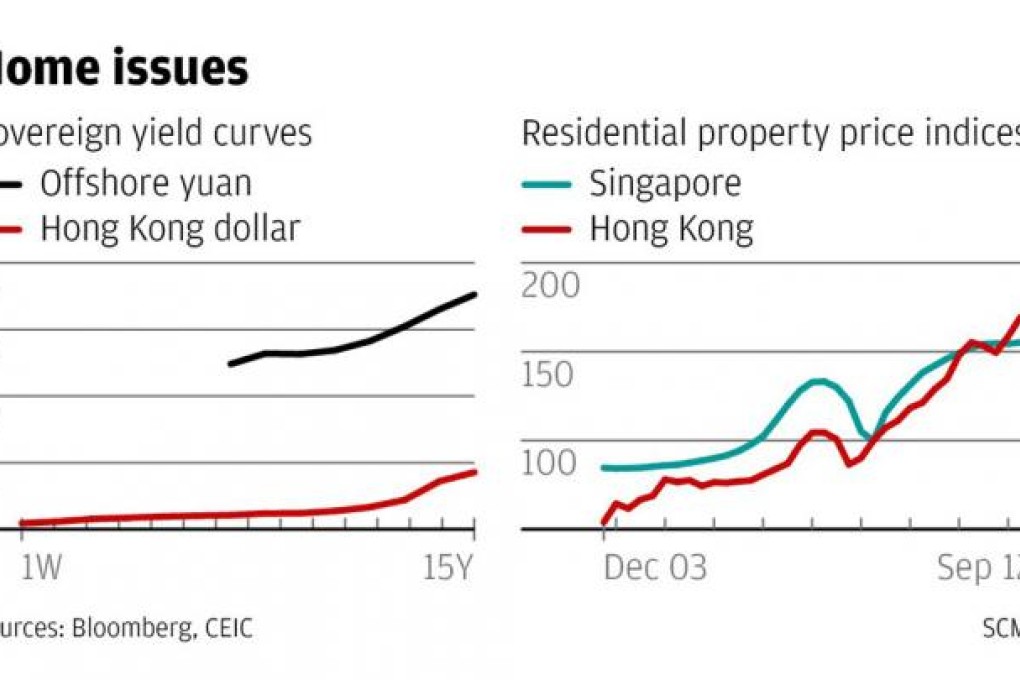

The real problem, he insists, is Hong Kong's currency peg to the US dollar, which forces the city to import US interest rates, whether the local economy is in step with the US business cycle or not.