Hong Kong feels effect of US stimulus moves

Despite assurances, the US stimulus efforts have pushed cash back into the emerging markets, and into the Chinese asset markets especially

Back at the beginning of last month, this column argued that Hong Kong property prices would continue to climb regardless of government efforts to increase the supply of affordable housing.

"If the US Federal Reserve does what many analysts expect next week and announces a new round of quantitative easing … it is likely that a fresh influx of liquidity into global asset markets will continue to push Hong Kong property prices higher," warned.

That comment attracted a fair amount of criticism from market analysts.

Several pointed out that although Hong Kong experienced massive liquidity inflows during the Federal Reserve's first bout of quantitative easing in 2009, the city saw no significant inflows during the second round between November 2010 and June last year. As a result, there would be little reason to expect sizeable inflows should the Fed embark on a third round.

After the Fed formally announced its new programme of easing last month, conventional wisdom still held that the impact on Hong Kong's markets would be minimal.

The new round of quantitative easing was qualitatively different from earlier episodes, explained one analyst. In the first round, the Fed bought US Treasury debt in the market. Under the new programme, the Fed is buying mortgage-backed securities.

That meant there was a big difference in the types of seller, he argued. The Treasury bond holders who sold in the first round were cross-border investors, who went on to allocate the cash they realised to international markets, including Hong Kong.

In the third round, sellers will be holders of US mortgage securities. They tend to be domestic US investors, so little cash will flow abroad.

Those arguments are all very well, but they severely underestimated the impact the Fed's open-ended commitment to buy securities, coupled with easing measures from the European Central Bank and the Bank of Japan, have had on investor sentiment.

When it became clear towards the end of August that the Fed was moving towards a fresh round of easing, global investors rediscovered their appetite for risk.

Heartened by the Fed's pledge to keep interest rates ultra-low for another three years, and encouraged by the ECB's more accommodating attitude, investors began channelling money into assets previously deemed too risky.

Capital flowed both into US and European stock markets, with benchmark indices gaining about 4 per cent over the following weeks.

But above all, cash flowed back into the emerging markets, and into Chinese asset markets especially. As a result, recent outflows of capital from China reversed, with mainland banks buying US$21 billion in foreign exchange last month, according to Thomson Reuters, in contrast to net sales of almost US$3 billion in August.

Capital flows into Hong Kong also picked up. At first they were absorbed by the banking system. According to Morgan Stanley, Hong Kong banks' net foreign assets (and hence their net domestic liabilities) grew by US$6.2 billion in August, ahead of the Fed's announcement.

Since then inflows have accelerated further, pushing the Hong Kong dollar up against the US dollar and on Friday forcing the Hong Kong Monetary Authority to buy US$603 billion to keep the currency within its permitted trading band.

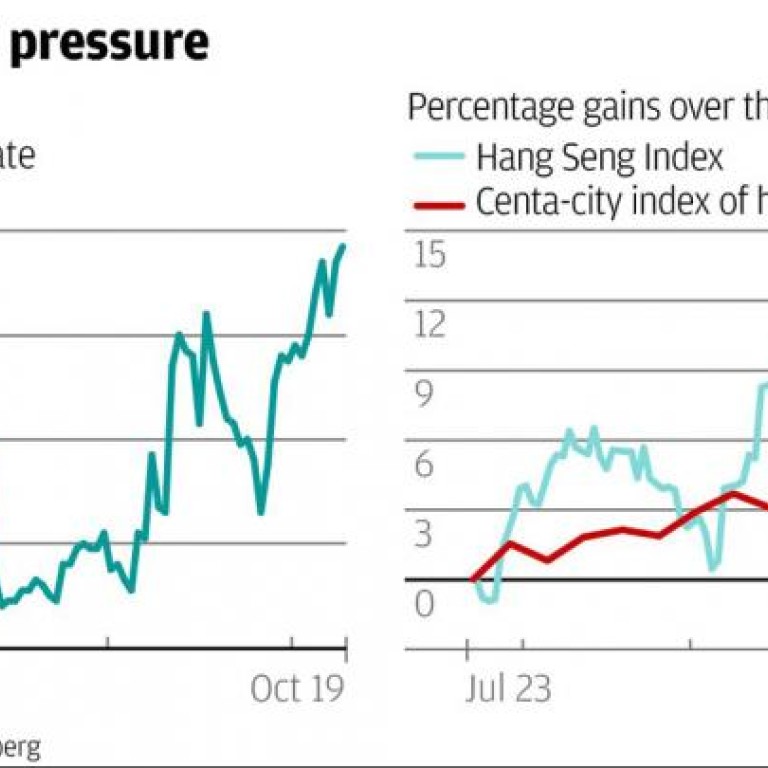

Not surprisingly, the inflows also have pushed up prices in Hong Kong's asset markets with the Hang Seng Index climbing 11 per cent since the end of August, and residential property prices rising 4 per cent.

Sure, the latest flows are tiny compared with the huge influx Hong Kong saw in 2009. But given the revival of sentiment towards China's economy, it's unlikely the inflows have finished yet. Expect more upward pressure on asset prices.