Monitor | Excluding mainlanders won't allay main property grievance

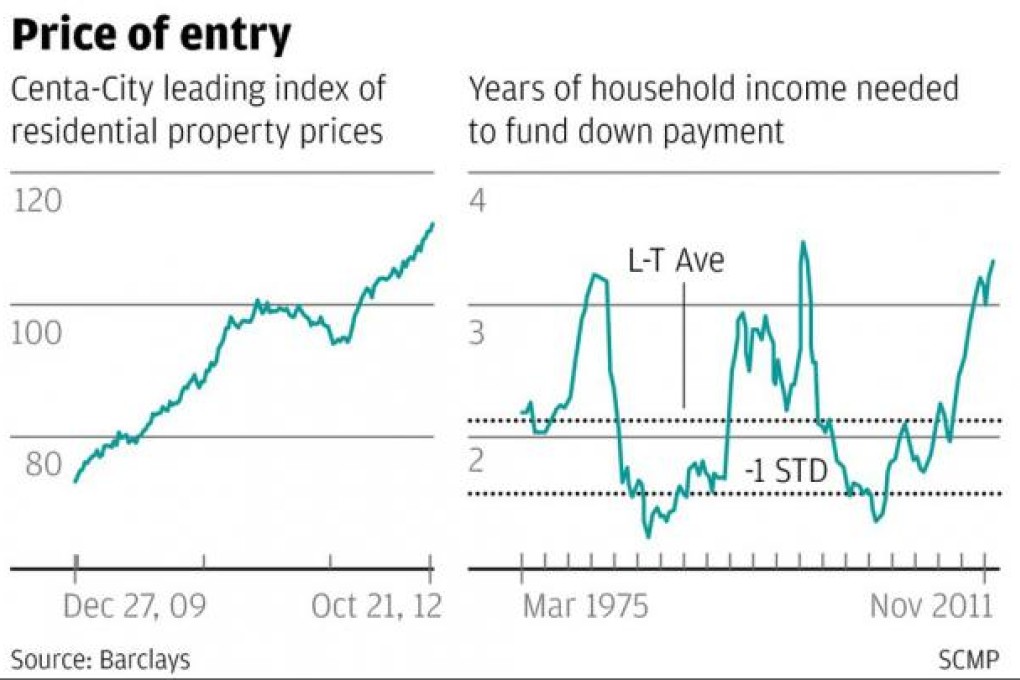

The major complaint is that the 30 per cent down payment is just too high for many first-home buyers to get into the housing market

On Friday evening Financial Secretary John Tsang Chun-wah announced two new punitive property tax measures aimed at "maintaining a healthy, stable property market".

Firstly, the government jacked up its two-year-old special stamp duties by 5 percentage points. From now on, anyone selling a flat within six months to a year of purchase will have to pay an extra 15 per cent stamp duty on top of the standard rate; 20 per cent if he or she sells within six months.

Secondly, all individual buyers of residential properties who are not Hong Kong permanent residents, and all corporate buyers, will be forced to pay an extra 15 per cent "buyer's stamp duty".

The first measure is intended to deter speculators from flipping their flats for a quick profit. The second is aimed at shutting mainland buyers out of the Hong Kong market.

"I would like to emphasise that the objective of the two new measures is to help alleviate the demand for housing by according priority to meeting the needs of Hong Kong permanent residents," explained the financial secretary.

First, despite what Tsang says, there is no housing shortage in Hong Kong.