Monitor | The great attraction of cash extraction

Home prices are still rising, perhaps it is because Hong Kong property owners have been re-mortgaging their homes to buy another flat

It's still too early for any hard numbers telling us about the impact of the latest government measures aimed at making Hong Kong property more affordable for local buyers.

But the initial signs are not encouraging. The latest data-point on the Centa-City leading index shows a steep 1.5 per cent price rise in the week following the late October imposition of punitive stamp duties on non-resident buyers.

Perhaps that shouldn't be such a great surprise.

Although sharply rising home prices have often been blamed on an influx of cash-rich speculators from the mainland - the group targeted by the government's new tax - one of the main drivers of recent price rises can be found rather closer to home.

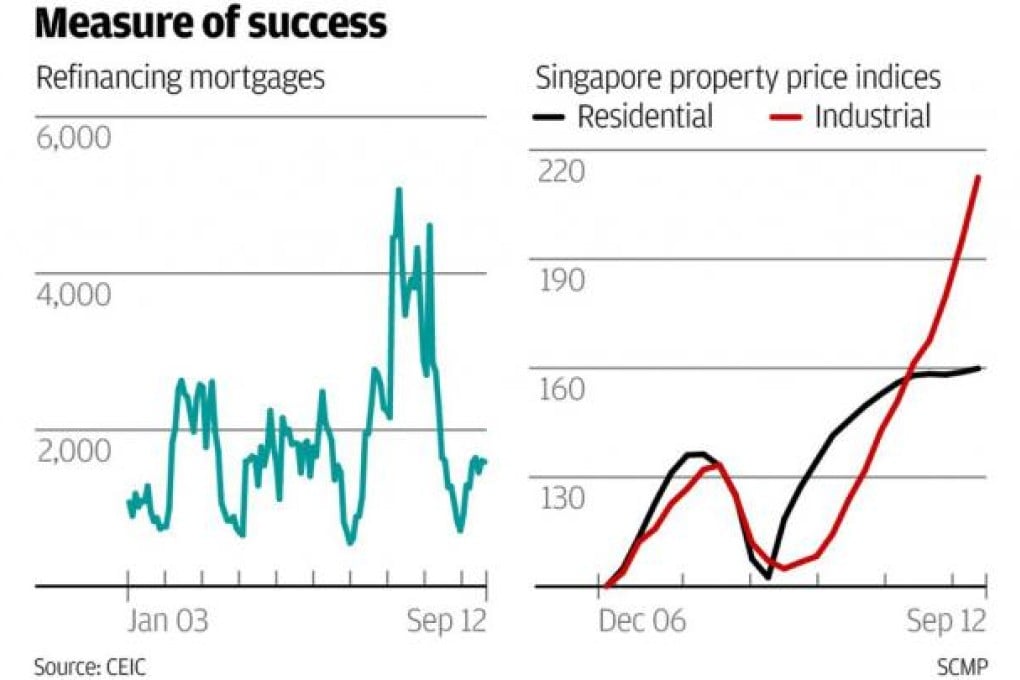

Over the last few years Hong Kong property-owners have been increasingly ready to use their flats as cash machines. Since the beginning of 2009, more than 100,000 have taken advantage of rock-bottom interest rates to take out a new mortgage on their existing homes.

They didn't embark on a spending binge with the money like US consumers in the years before the financial crisis. Instead Hong Kong borrowers took the cash they extracted from their homes and used it as the downpayment for another mortgage on a second flat.