A hard time feeling the struggle amid boom times

Despite official cries of a slowdown, a quick calculation of the top three components of gross domestic product paint a very different picture

When the Hong Kong economy struggles along at a growth rate of barely one per cent, as the latest quarterly economic report says it is now doing, there is a distinctively pinched feel to things.

I have a hard time feeling it at the moment. Traffic clogs the roads as rarely before, shoppers clog the shops, property prices are at record peaks, expatriate parents are screaming about the lack of school places, and all around I see the usual signs of boom time.

Where is this slowdown?

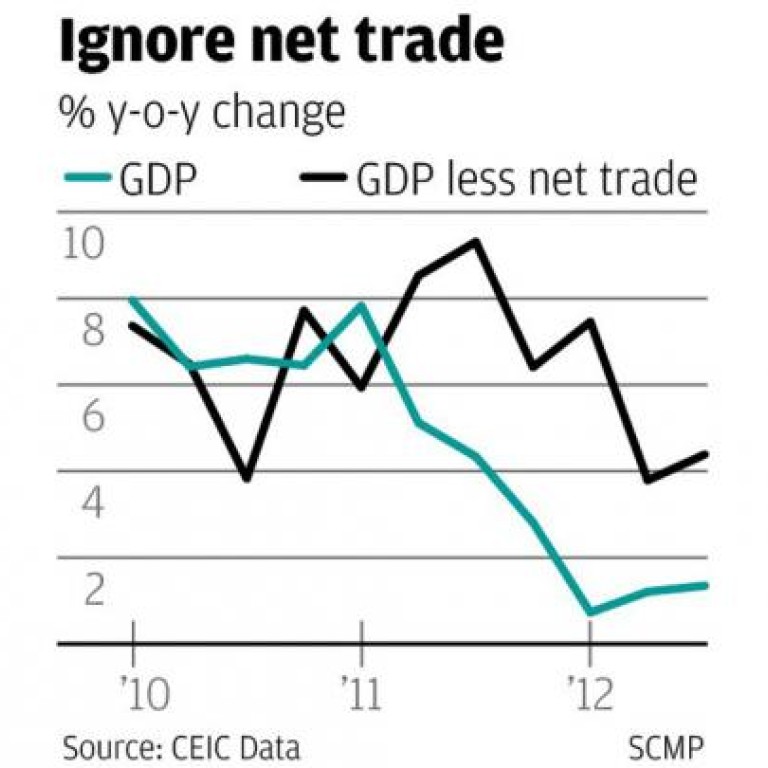

I suspect it exists in the statistics alone, and I can easily find a higher growth rate than the 1.3 per cent officially registered in the third quarter. Just add up the three largest components of gross domestic product (private consumption, public consumption and fixed capital formation). Together they account for about 97 per cent of GDP, and their combined growth rate in the third quarter was 4.3 per cent. As the chart shows, this figure has been consistently higher than the official growth rate since early last year.

The weak part of the total equation is net exports of goods and services, along with the related changes in inventories.

The fundamental reason that these trade figures pull down the official growth rate is that we insist on treating Hong Kong's foreign trade the same as any big country's, when what we actually have is anomaly piled on anomaly, and guesswork to make sense of them all.

Trade should be the easiest component of GDP to calculate accurately. Just add up the value figures in the documentation that accompanies the goods passing through our ports and you should have it. That's the way it works in most other places.

The way it works in Hong Kong is that almost 98 per cent of our exports consist of re-exports, goods on which we supposedly perform a little final work before sending them on to their final destination.

Any amount of work that would truly qualify these goods as re-exports, however, would make re-export processing the biggest industry in Hong Kong.

In fact, the processing consists only of changing the value figures in the documentation in order to cheat the mainland taxman. He connives. Don't ask me why.

But this leaves us with some uncertainties. We have to guess at the value of imports that remain in Hong Kong. We don't know for sure. It all depends on another guess of how much fake processing value was added to re-exports. Yet this retained import guess critically affects our economic growth rate estimates.

There is more. Our real trade is in services, not goods. Service exports amount to the equivalent of about half of our GDP and are 10 times greater in value than domestic goods exports.

But how do you accurately tot up the number of hours that all the lawyers and accountants in this town bill their foreign clients? How do you tally up the net interest margins that banks accrue this way? By guesswork, that's how.

There is yet more. Spending by non-residents amounts at present to about 16 per cent of GDP, most of it purchases of goods in our shops. The rules say we should not include this in our GDP calculations, and we do not.

But almost all of these tourist goods are imported. If we do not count them on their way out of Hong Kong we should also not count them on their way in. For what proportion of our imports do tourist goods account? Even guesswork won't suffice to answer this question.

There are many more like it. I think that the best way of measuring our economic growth is perhaps to ignore foreign trade entirely and just look at domestic demand. That is what gives me my 4.3 per cent growth rate.