Monitor | When the slump finally comes, home prices could fall by half

Putting a fair value on housing is no easy task but there are some worrying property numbers in terms of average real interest rates

I know this column has banged on ad nauseam about Hong Kong property prices recently.

But there's a couple of big topics we haven't tackled: how much Hong Kong homes are overvalued and how far prices can fall, and the major structural changes the government needs to make to ensure the market's long-term health.

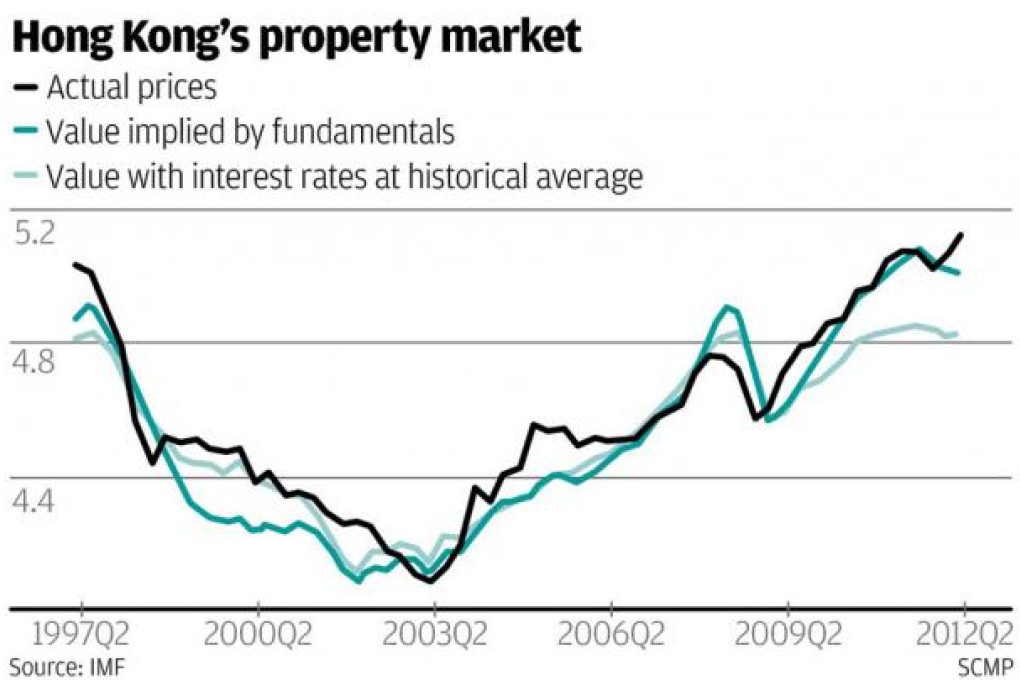

The structural changes can wait for another day. But given the government's pledge to ramp up housing supply, it's worth asking now how overpriced Hong Kong homes really are, and how deep any eventual correction is likely to be.

Unfortunately, putting a fair value on housing is tricky. On the face of it, property looks eye-wateringly expensive. The average Hong Kong family would have to put aside every penny it earned for almost 13 years to save enough to buy a typical flat in the city. That's four times as long as the average American family would have to save.

But high prices alone don't mean the market is overvalued. Other measures indicate that Hong Kong's property prices are more or less in line with what you would expect.

Certainly there is no credit-fuelled housing bubble. The levels of both residential mortgages and overall property loans are slightly below their 10-year average relative to total Hong Kong dollar loans, and both are falling as a proportion of overall bank lending.