Monitor | Beijing can't afford to rein in the shadow financing system

Amid structural changes and political necessity, most new lending takes place underground but the market’s sheer size may be a problem

According to mainland media reports, Beijing has set this year's quota for new bank loans at nine trillion yuan (HK$11.11 trillion).

Now, nine trillion yuan sounds like a lot of money. Certainly it's more than the 8.2 trillion yuan in new local currency loans Chinese banks made last year.

But in relative terms, it's much the same. Last year's new loan total of 8.2 trillion yuan was 15.8 per cent of the mainland's gross domestic product. Assuming real economic growth this year of 8 per cent and economy-wide inflation of 2 per cent, this year's lending target will also be 15.8 per cent of GDP.

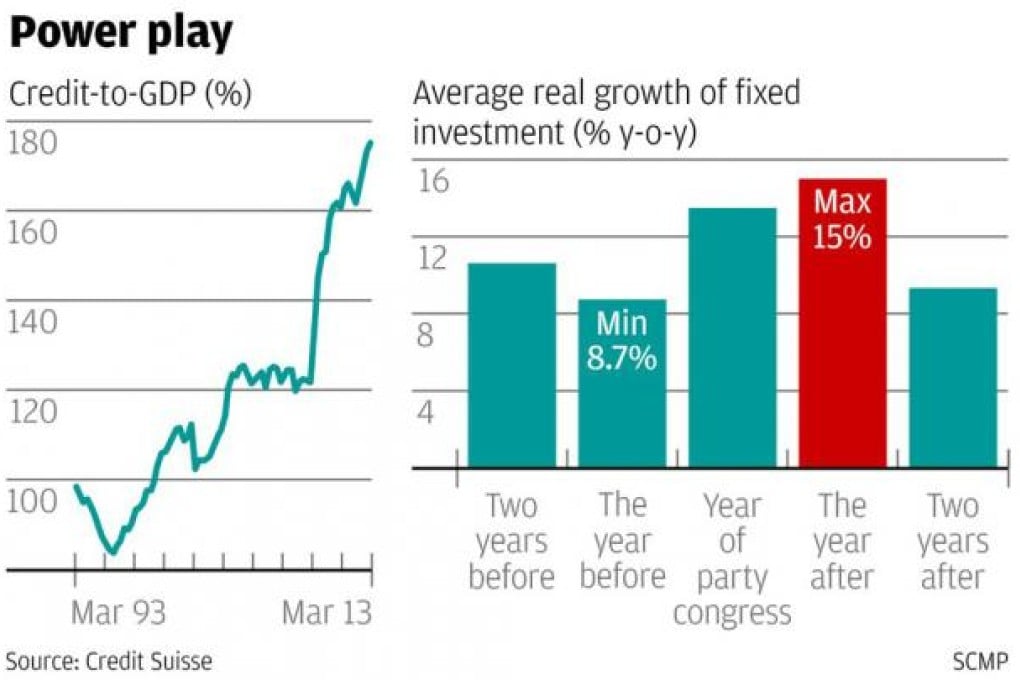

On the surface this makes it look as if the authorities have determined to curb rampant credit growth, which in 2009 saw new bank loans hit almost 30 per cent of the country's GDP.

But the structure of mainland financial markets has changed in the intervening years. These days much new lending takes place away from the banking sector's balance sheet via a shadow financial system of wealth management products and company-to-company loans, while the corporate bond market has exploded.