Monitor | Davos talk of new currency war is wildly exaggerated

Worries about the Bank of Japan's money-printing efforts to breathe inflationary life into the country's economy are highly overblown

Just as sentiment towards the world's economy and financial markets was perking up, the legion of praters assembled in Davos over the weekend found something else to worry about: the threat of a global currency war.

Their fears are overblown.

Talk of currency wars is nothing new. Politicians from the United States have long accused Beijing of stealing an unfair economic advantage by deliberately holding down the yuan in order to promote Chinese exports abroad while pricing imported goods out of China's domestic market.

In turn Chinese officials complain that the US Federal Reserve's ultra-loose quantitative easing policy is a ploy to debase the US dollar and erode the real value of China's vast holdings of US debt.

This time, however, it is neither China nor the United States at the centre of the global slanging match, but Japan.

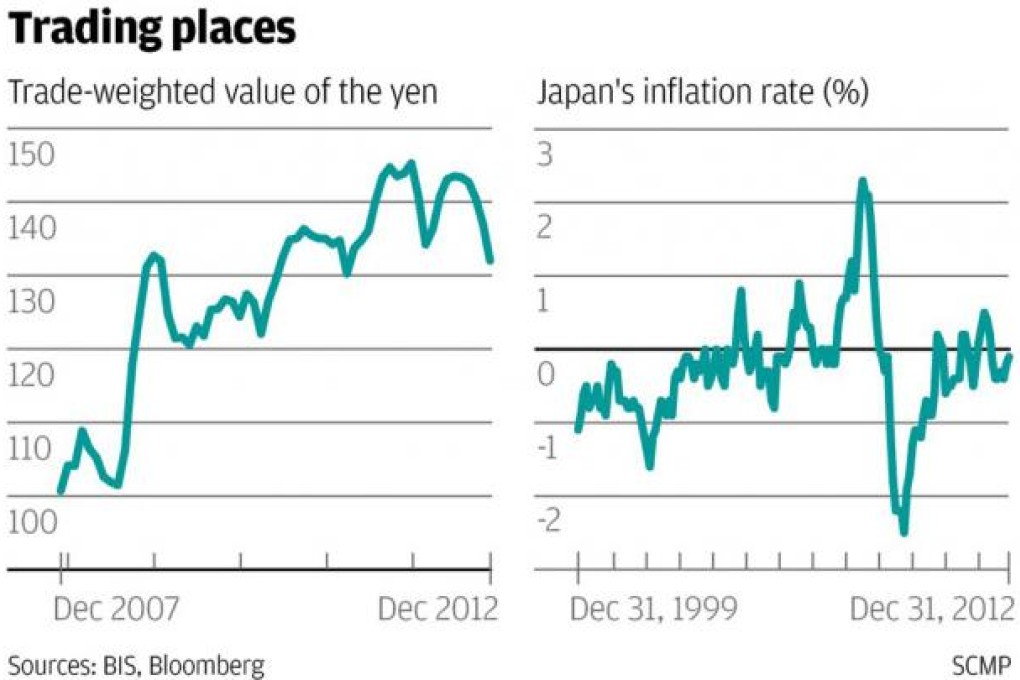

In a bid to revitalise the country's ailing economy, the Bank of Japan announced last Tuesday that it would adopt a new policy of inflation targeting - with its desired rate of price increases set at 2 per cent - and said it would embark on an open-ended programme of money-printing in an effort to hit its target.