Monitor | Commodity bears should look again at China's credit growth

While analysts have painted a gloomy outlook for the resources sector, the surge in new financing suggests robust demand for commodities

There's been a lot of chatter over the past couple of weeks that the 10-year-old "super-cycle" in commodities may have peaked and that prices are now set to trend lower over the coming years.

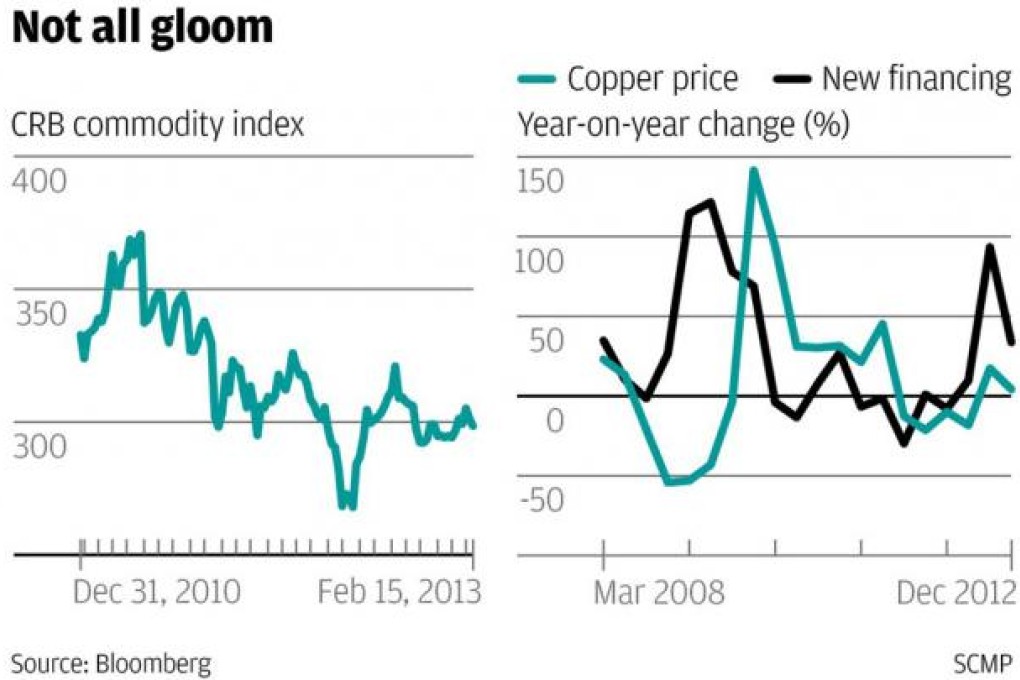

You can see why investors are worried. As the first chart below shows, commodity prices have struggled to perform lately. Since its early 2010 peak, the Thomson Reuters/Jefferies CRB Commodity Index has fallen by almost 20 per cent.

That slump has caused a lot of pain in the resources sector. Last week, mining giants Rio Tinto and Anglo American both announced full-year losses for 2012 after heavy write-downs on their investments.

Over the next few weeks, other big miners including BHP and Vale are expected to announce big falls in their net profits for last year.

To make things worse, commodity analysts don't see much chance of any revival any time soon.

After China recorded its weakest economic expansion since 1999 last year, talk abounds that the world's biggest consumer of commodities is shifting to a structurally lower growth trajectory.