Investors' fears of fiscal tightening by Beijing are over-blown

Stock markets in Hong Kong and on the mainland dived yesterday as investors reacted to overblown fears of fiscal tightening by Beijing

All it took was a warning from Beijing that the mainland's local governments should keep a tight rein on property market speculation, coupled with a move from the central bank to drain some liquidity from the mainland's money markets, and stock markets went into full panic mode yesterday.

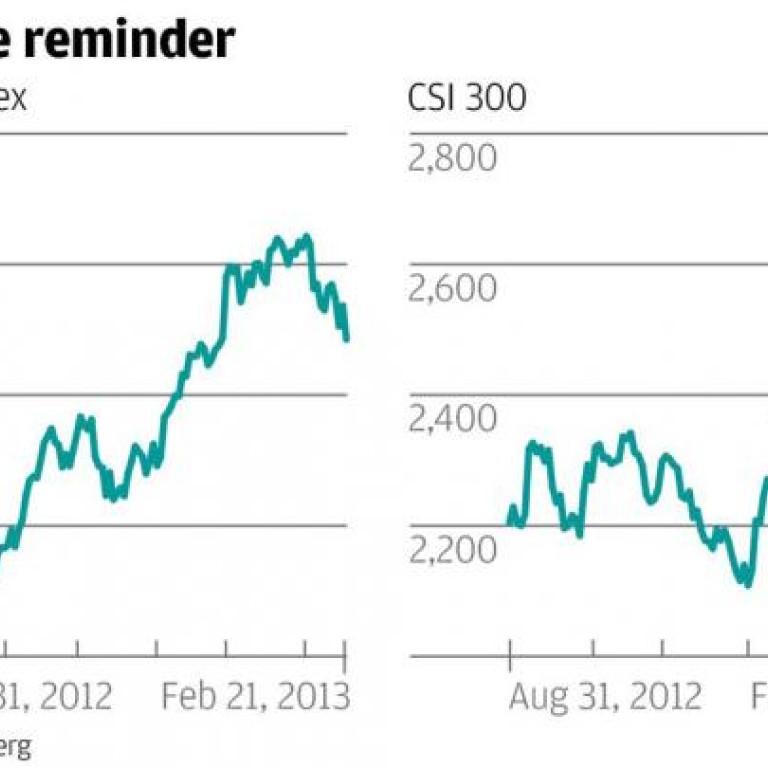

Afraid that the mainland authorities were about to institute another round of monetary tightening, investors rushed for the exits, knocking 1.7 per cent off Hong Kong's benchmark Hang Seng Index, while the city's H-share index of locally listed Chinese stocks slumped 2.2 per cent.

At the same time, on the mainland, the CSI 300 index of big companies tumbled a painful 3.4 per cent.

After yesterday's falls, the 30 per cent-plus climbs in both H shares and the CSI up to the end of January seem increasingly distant memories. Both indices are now down more than 6 per cent in the past few weeks.

Despite the rout, however, stock market investors should not be too downhearted.

Beijing's warning on property speculation might have sounded fierce. But in reality it was simply a reminder that local authorities should keep present controls on speculative buying in place. It contained no new restrictions.

Yes, the State Council did reiterate plans to extend property tax trials to more cities. But as analysts at Bank of America pointed out, rolling out a country-wide tax is likely to take years, especially in the face of stalling by local officials, who are extremely reluctant to disclose their own personal property holdings to the taxman.

At the same time, the central bank's move this week to withdraw around 900 billion yuan (HK$1.11 trillion) of liquidity from the mainland's money markets merely drains away some of the excess cash it injected in the run-up to the Lunar New Year holidays.

It was more of a housekeeping measure than a decisive change of policy.

Yet yesterday's sell-off still holds a valuable lesson. It emphasises the extent to which stock markets are being propelled by liquidity, or rather by investors' expectations of future liquidity. And the outlook for future liquidity remains buoyant.

Despite some questions, the US Federal Reserve's ultra-loose monetary policy settings are likely to remain in place well into next year. As a result, Hong Kong's asset markets are likely to see continued fund inflows.

With China's official rate of consumer price inflation relatively stable at just 2 per cent and the authorities showing a clear bias in favour of growth this year, there appears little chance of any major tightening of mainland liquidity conditions any time soon.

Granted, Beijing may continue to make cautioning noises about property market controls, and may even threaten to re-impose restrictive lending quotas on the country's banks.

But the effectiveness of loan quotas has been greatly diluted by China's rapidly growing shadow financial system and corporate bond market, which, over recent months, have together accounted for more than half of all new credit created in the mainland economy.

In any case, a determined crackdown is unlikely, considering this year will mark the peak of local governments' investment spending commitments under Beijing's current five-year plan, which means local authorities need continued access to cheap funding, whether through bank loans or the bond market.

As a result, liquidity is likely to remain plentiful for the time being.

And experience has shown that when liquidity is plentiful, enough leaks into the stock market to keep equity prices well supported.

So despite the ferocity of yesterday's sell-off, the conditions which propelled the stock market bull run of the past few months, both in Hong Kong and on the mainland, remain very much in place.