Monitor | Signs of nightmare scenario in China's latest economic data

Alarming declines in export orders and job prospects on the mainland conjure a vision of dark economic times that some say are already here

There is a nightmare scenario for China's economy, and it looks something like this:

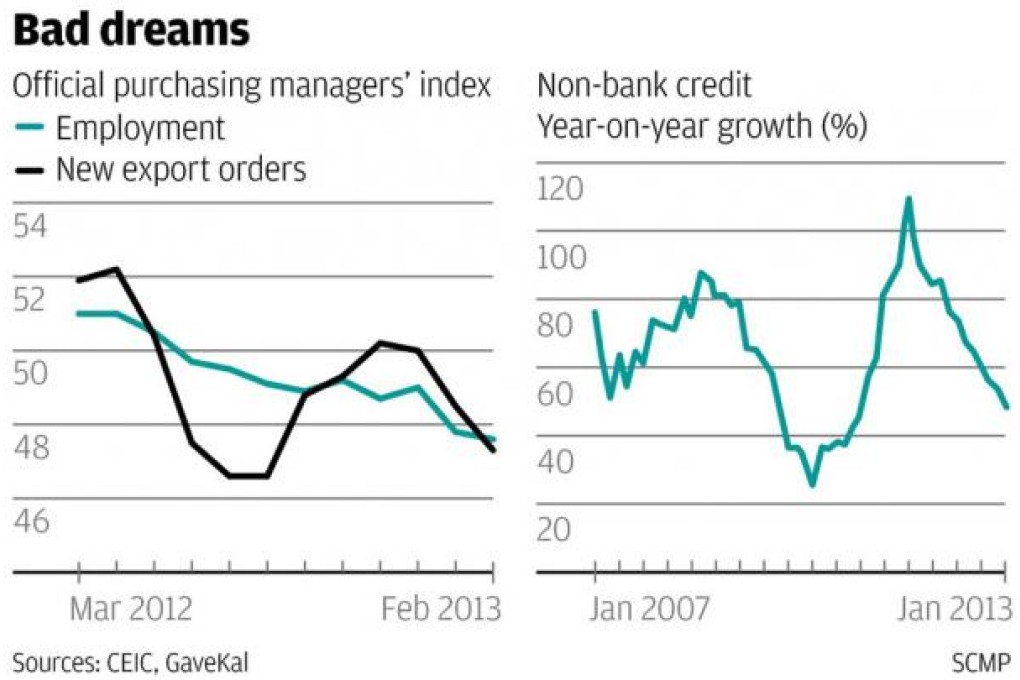

With the euro zone sunk in recession and high unemployment in the United States depressing household consumption, weak international demand weighs heavily on China's export sector.

Anxious to maintain growth rates and job creation, the authorities in Beijing sanction an increase in domestic credit in the hope that easier access to funding will encourage firms to step up their pace of investment.

New lending, both directly by the country's state-owned banks and indirectly through shadow-system institutions like trust companies, duly surges.

Unfortunately, things don't quite work out as Beijing intended. With many industries already suffering from overcapacity following the 2009 to 2010 investment binge and profit margins under pressure as a result, companies, especially in the private sector eschew further capital spending on new capacity.

Instead, borrowers channel the funds into high-risk speculations in the property, commodity and equity markets. Asset prices pick up smartly, creating the impression of a robust economic recovery.