We see that Barry Cheung Chun-yuen did not come away empty-handed after his six-month stint as Rusal's chairman. It will be recalled that Barry stepped in, where possibly others feared to tread, when Viktor Vekselberg abruptly resigned from the Hong Kong-listed aluminium company in March last year citing corporate governance problems. He has since gone on to bigger, and arguably, better things and is poised to become Russia's richest man after the completion of Rosneft's acquisition of TNK, in which he is the biggest individual shareholder. Oleg Deripaska, Rusal's controlling shareholder and CEO, was also once Russia's richest man.

It is true that Cheung's chairmanship lasted longer than many thought it would when an ally of Russian President Vladimir Putin, Matthias Warnig, was elected to the board in June. Many thought Warnig would take over as chairman and eventually took over in October giving Cheung six months in the job.

According to Rusal's annual report for 2012 Cheung was paid US$414,000. He was presumably paid chairman's rates for his six months in the post and as an independent non-executive director for the other six months. At 2011 rates this would have totalled US$355,000. He appears to have been paid a US$59,000 premium possibly for the indignity of only having the job for six months. This doesn't seem a lot by current standards of corporate largesse, but it's better than a poke in the eye.

The Hong Kong Lipper Fund Awards shindig for 2013 got off to a flying start with Reuters' silver-tongued Tara Joseph reminding the assembled that the Financial Secretary had referred to this event as the Oscars of the fund management industry. This lifted spirits as fund managers momentarily basked in the warm glow of the glamour and glitz associated with Hollywood before being brought down to earth with talk of fund flows and Lipper's methodology for calculating fund performance.

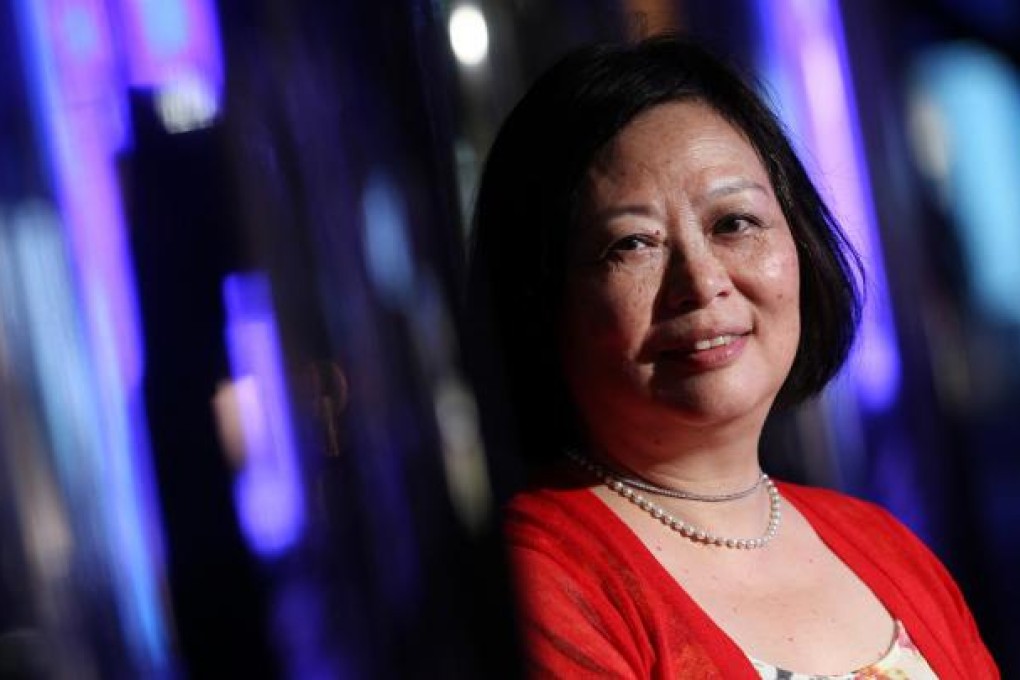

The mood was further broken by some straight talking from Anna Wu, chairman of the Mandatory Provident Fund, who, perhaps somewhat unkindly, teased them. "You would have noted and hopefully are already aware of our focus on examining ways to get a simpler and more cost-effective system …" By this she meant bringing down fees, simplifying and consolidating funds, using more passive funds. In short, signalling the end of the gold-plated arrangements the fund industry has enjoyed with respect to the MPF, eating their lunch before their very eyes.