Monitor | Danger China is repeating America's pre-crisis errors

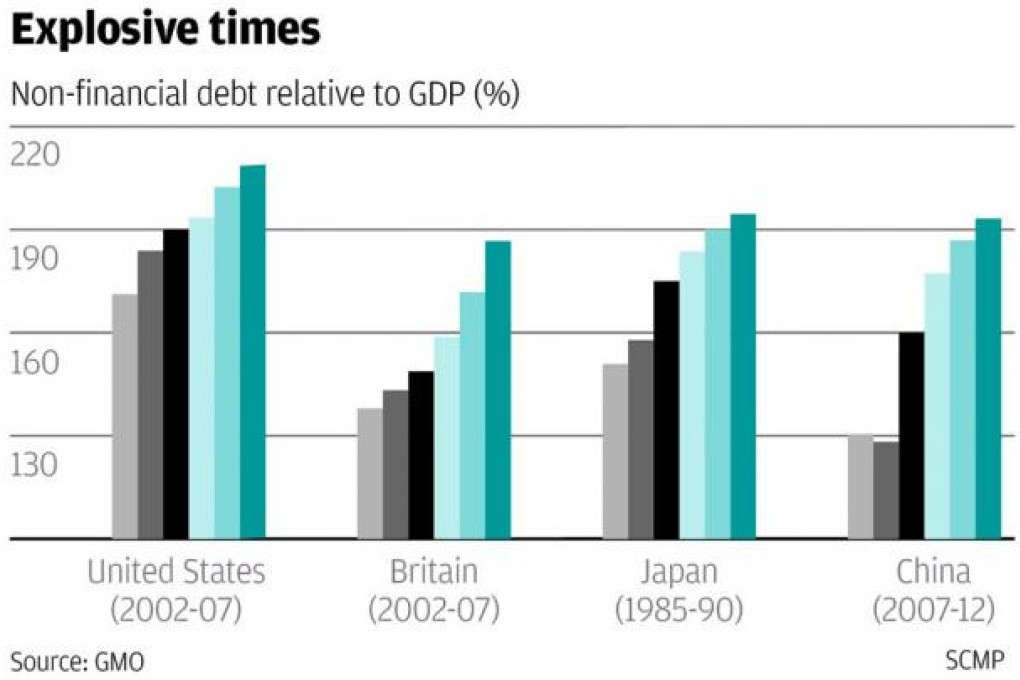

Mainland credit boom risks spiralling out of control, with the huge loans handed out by state banks needing to be serviced with ever more credit

In 2001, policymakers in the United States made an enormous blunder. Now China may be repeating the same mistake.

Freaked out by the collapse of the dotcom bubble in March 2000, and afraid of a powerful economic downdraft following the terrorist attacks on New York and Washington in September 2001, the Federal Reserve slashed interest rates.

Between the end of 2000 and mid-2003, the Fed cut its target rate 13 times, from 6.5 per cent to just 1 per cent.

Credit creation ballooned. At the same time, investors' demand for returns in the low-yield environment triggered an explosion in financial engineering.

The result, five years later, was America's biggest financial crisis since the Wall Street crash of 1929 and its deepest economic slump since the 1930s.

When that crisis struck, the response Beijing came up with read straight from the Fed's playbook.