Monitor | South Sea Bubble warning for wealth management investors

CBRC probe into pooled funds either good news or cause for concern institutions will hit problems repaying investors in existing products

In his classic Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, Charles Mackay detailed some of the investment absurdities of London's South Sea Bubble of 1720.

In one case, the prospectus for an initial public offering described simply "a company for carrying on an undertaking of great advantage, but nobody to know what it is".

It sounds ridiculous to us, but the issuer guaranteed investors they would make annual returns of 100 per cent. His office was promptly besieged by eager punters, and in the course of just six hours, he took subscriptions - and deposits - for £500,000 worth of shares. Today that would be worth HK$668 million.

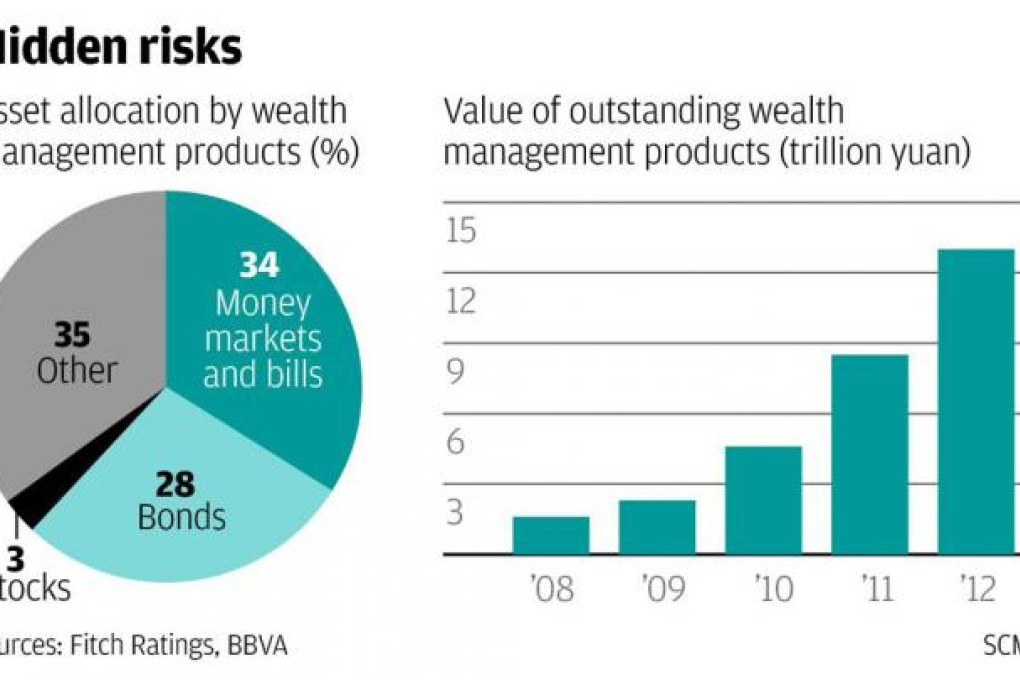

It's easy to laugh, but many of the mainland savers currently queuing up to buy wealth management products from their banks have no more idea what they are purchasing than those 18th-century Londoners. Just like their forebears, they have been beguiled by offers of high returns.

So depending on your point of view, a report yesterday in the quasi-official China Securities Journal that the China Banking Regulator Commission is to launch a major investigation into these products is either good news or deeply worrying.