Monitor | New arguments for gold sound like the old story warmed up

All that safe-haven buying may push the price of the precious metal higher and even to a record, but the bubble will eventually burst

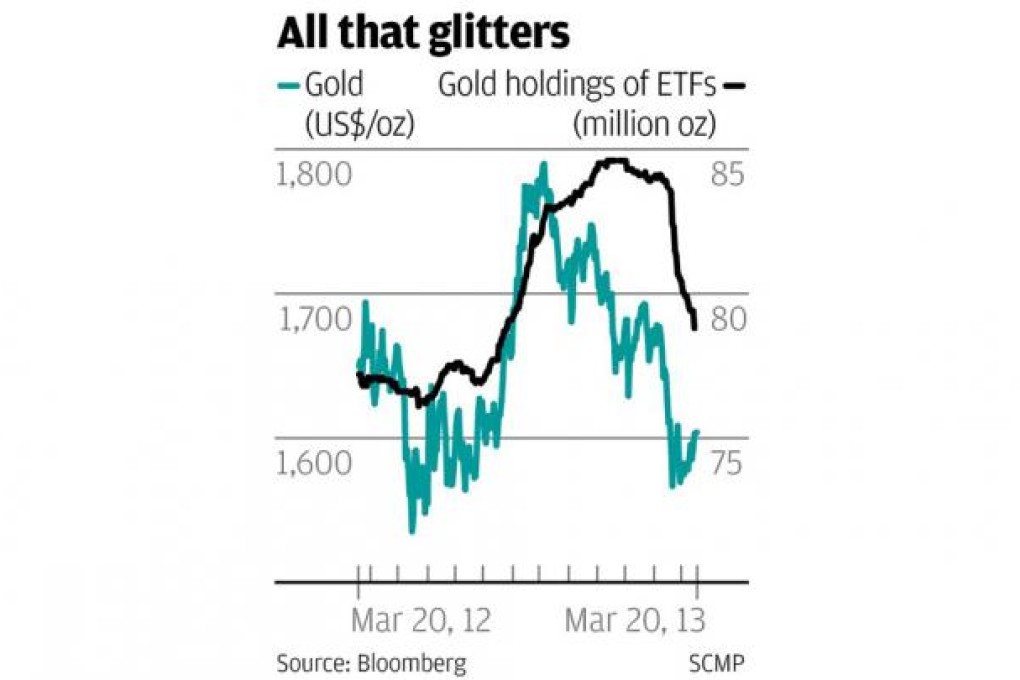

One tangential result of the sharp rise in risk aversion following the Cypriot debt crisis is that the price of gold has popped higher.

Yesterday, bullion was trading in Asia at US$1,601.86 an ounce, up 3 per cent over the past month.

You might think the latest price gain on the back of safe-haven buying can have done little to console gold's true believers.

Over the past 18 months, they have watched helplessly as the metal's price slumped, falling almost 20 per cent from its high of US$1,921.15, reached in September 2011.

But gold bulls are a hardy breed, not readily dismayed. The way they tell it, the market has just been taking a breather. Now, gold is poised for a fresh surge towards new - even more shining - record prices.