Sluggishness and high prices not only reasons for SOE losses

While state firms play the blame game, a look at their financial statements reveals the role of growing bills for staff and benefits

The managements of various state-owned enterprises have been blaming a sluggish global economy and falling prices for their multibillion-yuan losses and profit nosedives in the past two weeks.

A look into the financial statements of various non-financial companies in the past 13 years, however, shows that the problem is elsewhere.

It is inefficiency - as illustrated by the growing number of staff and rising costs - that has made the companies vulnerable to economic hardship. It is the same illness that Beijing has tried to cure by international listings of companies over the past two decades.

Let's look at China Eastern Airlines. It was listed in February 1997 - the first of its kind - to launch the country's reform of its aviation industry.

Yet, it was also the first to ask for a government bailout after the financial crisis. Between 2008 and 2012, it received a total of 103 billion yuan in capital injections from the government - the largest ever - to repay debt.

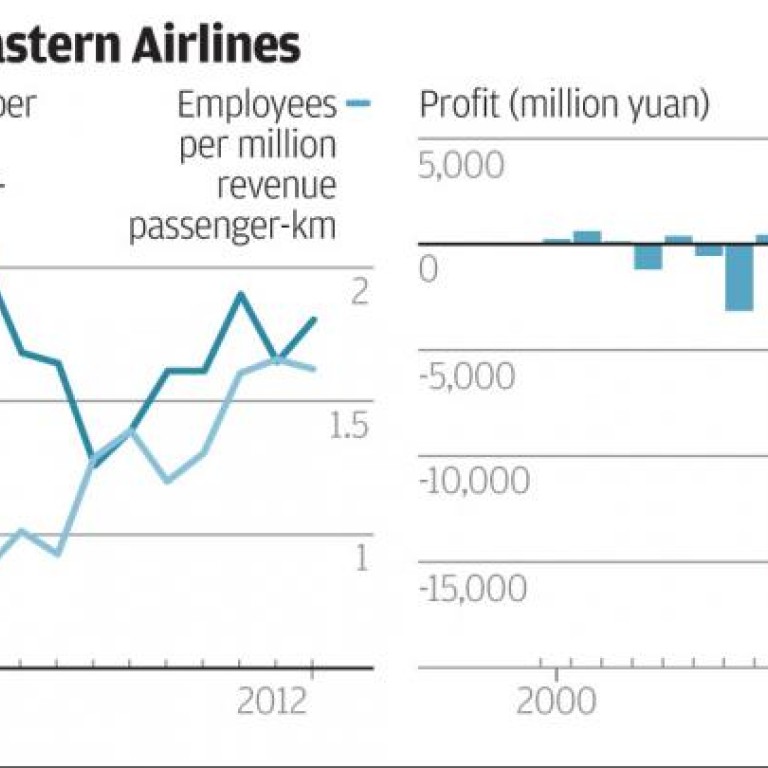

Last year, China Eastern saw its profit drop 37.7 per cent to 2.8 billion yuan (HK$3.46 billion). The management blamed it on the slow economy, rising fuel prices and high finance costs.

That's convenient. Its fuel bill did increase by 2.6 per cent and 36 per cent of its operating expense went to fuel. What it did not blame is the 16 per cent growth in staff costs, which accounts for 12.8 per cent of its operating cost. What it did not blame is the 10.6 per cent expansion in headcount.

This was no exceptional year. Between 2000 and 2012, the growth in its staff bill and fuel costs has been on par - 11.4 times for the former and 11.8 times for the latter. In the period, its staff size more than quadrupled to 66,207. The pay and benefit for each employee climbed from 61,307 yuan in 2000 to 151,930 yuan in 2012.

Even in 2009 - a year after a 15.2 billion yuan loss and a seven billion yuan capital injection from Beijing - its staff bill climbed 13.2 per cent. In the same year when management made a high-profile announcement of a 20 per cent pay cut, the salary and benefits for each employee grew more than 9 per cent.

The management explained that away by blaming inflation, fleet growth and a performance-linked pay scheme. Let's examine it one by one.

First, the inflation. Per capita staff costs grew 7.22 per cent annually over the past 13 years. The highest inflation rate during those years was 5.4 per cent in 2011. Either the management is poor in cost control or Beijing has been lying about inflation.

Second, the capacity expansion. The basic amount of production that an airline creates can be measured by revenue passenger-kilometre (RPK). In 2012, it took 1.64 employee to serve a million RPK. It was 0.92 in 2000. There is every sign of overstaffing.

Third, the performance. If you take away a government subsidy of 1.7 billion yuan, its net profit has grown by only 5.7 times during the period. That is way below the staff bill rise.

In the past 13 years, the airline's net profit climbed by 15.04 times. Does that make the 11.6 times rise in staff cost reasonable? No.

In a tough environment, staffing is perhaps the only area in which airlines do have some control. Other costs such as fuel, airport charges and leases are out of their hands. To save money, labour-intensive tasks have been pushed to passengers. There are internet and kiosk check ins, and sales via the web.

When the country's economy is expanding vigorously, you can easily hide your complacency and inertia. You can have a good time and be happy that reform has been successful.

This has been the case with not just China Eastern but many other mega SOEs, as I will try to show in the columns to come.

The question is, now that China's economy is slowing down, how they are going to survive the hard times ahead?