Monitor | China's fury at Bank of Japan 'blackmail' makes zero sense

Outrage over Japan's efforts to kick-start its moribund economy gives lie to Beijing's insistence that it doesn't undervalue its own currency

China's leading economists are "furious" with the Bank of Japan.

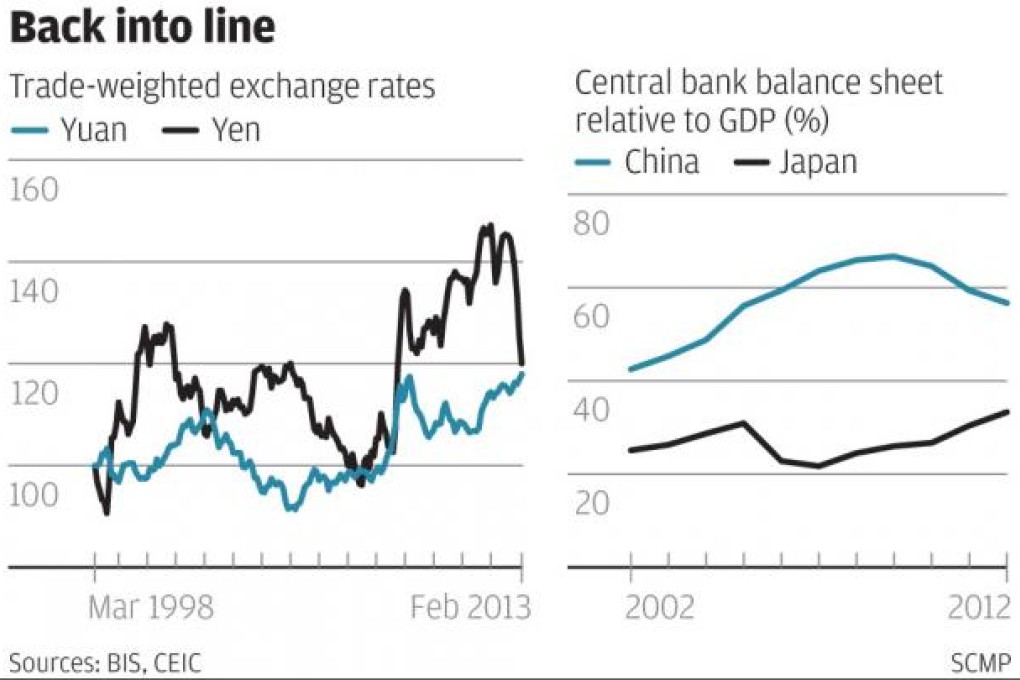

According to the story on the front page of Saturday's South China Morning Post a host of mainland economic bigwigs led by former People's Bank of China monetary policy committee member Li Daokui are "livid" at what they see as the BoJ's efforts to devalue the yen.

One disgruntled economist even accused the BoJ of "monetary blackmail" and called on the Chinese authorities to retaliate in kind.

No doubt there are lots of things an intelligent person could legitimately get furious about these days - pollution, injustice, the abuse of power - but, really, the Bank of Japan's monetary policy isn't one of them.

What's upset China's economic pundits is last week's announcement by new BoJ boss Haruhiko Kuroda that he intends to hit his inflation target of 2 per cent within the next two years.

And to achieve that target - no mean feat in an economy that has been locked in deflation for the past four years - he plans to print enough money to double the size of Japan's monetary base by the end of 2014.