Monitor | No need to worry about China's competitiveness

A shrinking labour pool and rising wages could mean the start of an economic rebalancing act and not a feared loss of manufacturing edge

Fears have been growing recently for China's competitiveness.

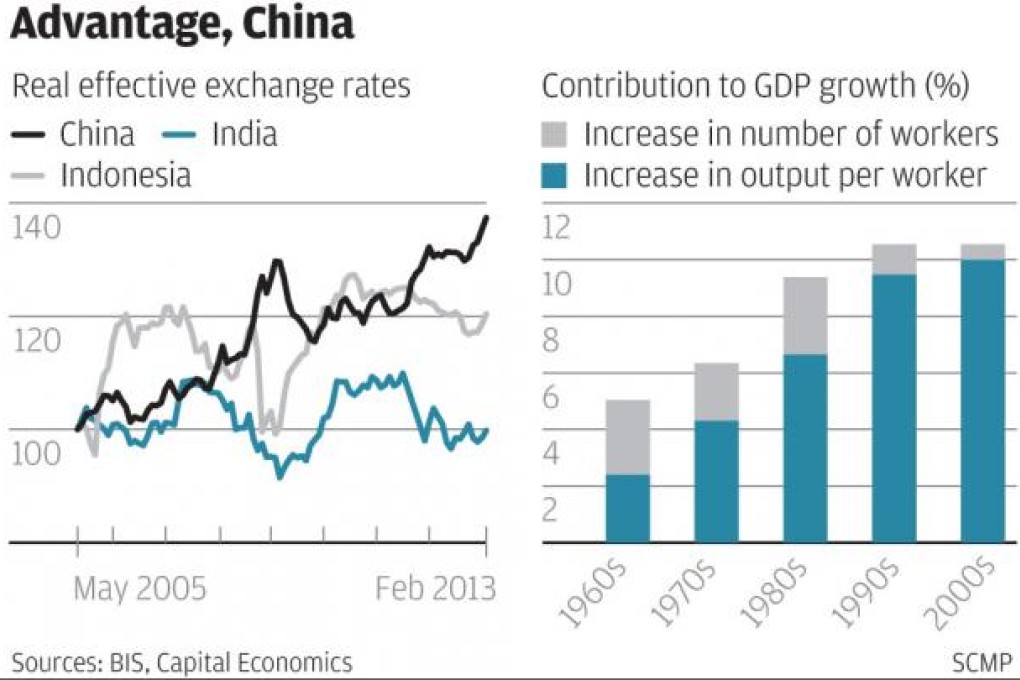

On one hand, investors fret that the appreciation of the yuan is eroding the competitive edge of China's factories compared with their rivals in Southeast Asia.

On the other, they worry that the contraction in China's working age population will push wages up to uncompetitive levels.

At first glance, it looks as if their fears are justified on both counts.

The yuan has strengthened by 34 per cent against the US dollar since it was revalued in June 2005.

More to the point, the yuan has appreciated relative to other Asian currencies. Measured against an inflation-adjusted basket of China's trading partners and competitors, the yuan has climbed by almost 40 per cent since June 2005.