Advertisement

Monitor | Being right too early is as bad as being wrong

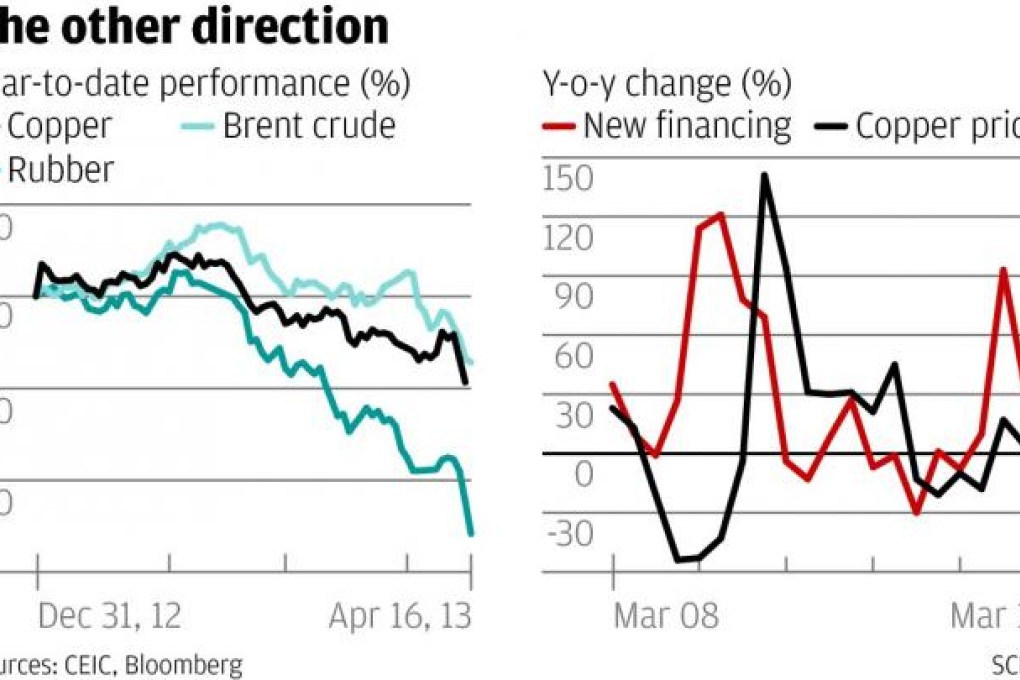

Infrastructure investment should now lift growth, which will in turn renew demand for commodities – just a little later than predicted

Reading Time:3 minutes

Why you can trust SCMP

I was wrong, badly wrong.

Back in February this column looked at the prospects for commodity markets in 2013.

Advertisement

With prices down, and major mining companies announcing losses, I examined the arguments that prices had further to fall.

And I dismissed them. My reasoning was simple, neat and - as it has turned out - completely and utterly wrong.

Advertisement

"Resource bulls shouldn't be too downhearted about the prospects for commodity markets this year," I concluded. "Don't write investments in the sector off just yet."

Advertisement

Select Voice

Select Speed

1.00x