Jake's View | A decade of growth but no sign of a fair share

The mainland economy is five times as big as it was 12 years ago but Shanghai's stock market has gone nowhere amid barriers to profitability

The China Securities Regulatory Commission published a new guideline on mutual fund operations after the market close yesterday, stipulating that stock-focused funds must spend at least 80 per cent of their assets to buy stocks, up from the current requirement of 60 per cent.

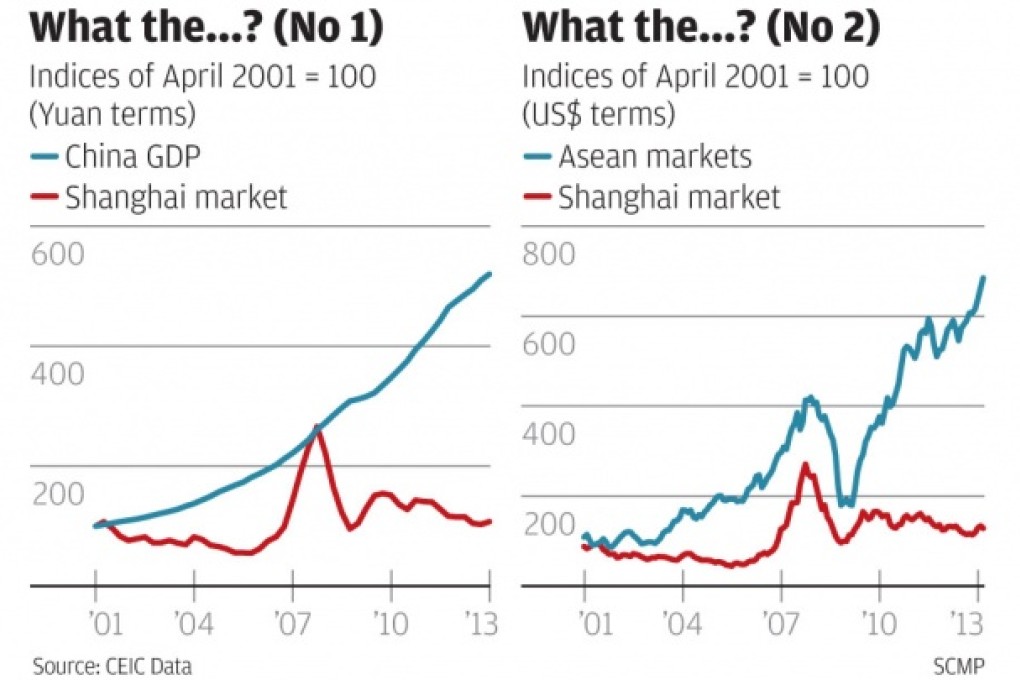

Let's first set out just how awful the performance of the Shanghai stock market has been. They say a picture is worth a thousand words but, as pictures cost me only a hundred words each in this column, I'll give you two.

The red line on the bottom of the first chart represents the Shanghai Composite Index set to a base of 100 for the end of April 2001. This date is exactly 12 years ago and the Shanghai index is exactly where it was back then. The blue line angling upwards represents the mainland's nominal gross domestic product calculated on the same basis. It is now more than five times as great as it was 12 years ago.

Find me anywhere else in the world where a stock market has done precisely nothing while the economy on which it is based has quintupled in size. Happy hunting.

The second chart compares the Shanghai index to the weighted average performance of stock markets in Asean. Yes, you know, those little countries at the bottom of the map of Asia, which everyone has forgotten about for years because China is the big thing, don't you know. To aid memory, this index comprises the Philippines, Thailand, Malaysia, Singapore and Indonesia.