Monitor | Morgan Stanley's 'bull tail' sees Hang Seng at 50,000

Scenario may sound unfeasible but the Hang Seng Index's 44-year history implies the chance it will make such a rapid gain is strong

Morgan Stanley's chief Asian equity strategist Jonathan Garner raised more than a few eyebrows yesterday among the 1,000 or so portfolio managers assembled in the ICC for the bank's Hong Kong investment conference.

He told them there is a "credible" chance that the city's benchmark Hang Seng index could reach the 50,000-point mark before the end of 2015.

With the index closing yesterday at 22,989.8 points, down 1.4 per cent from Friday, his scenario would deliver investors a return of 117.5 per cent in little more than 2-1/2 years.

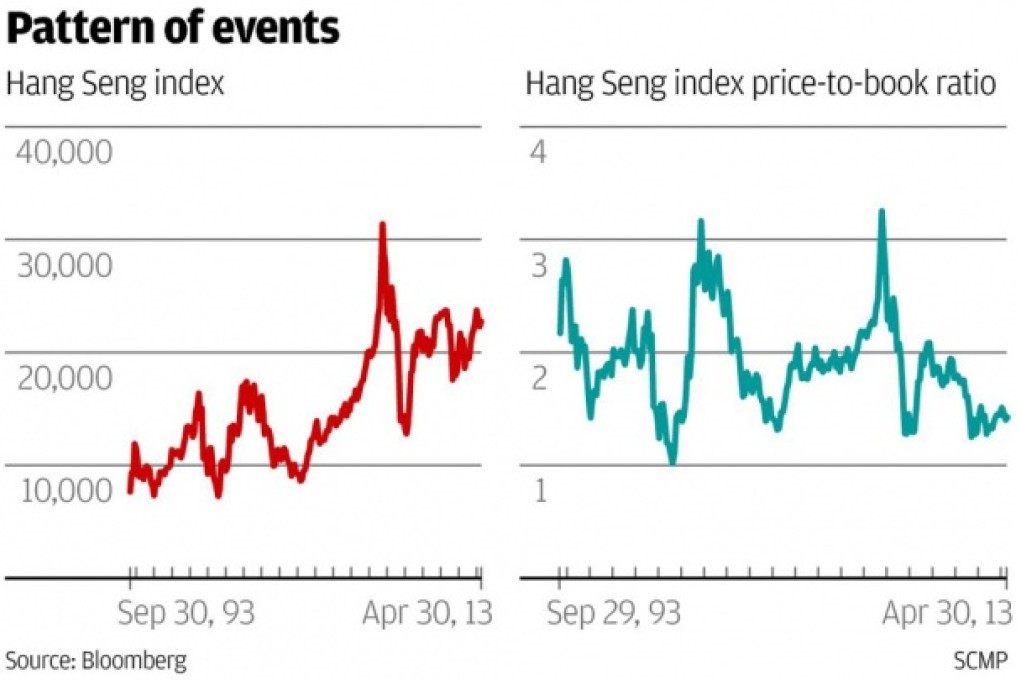

That might sound unfeasibly bullish. But as Garner points out, in historical terms such an extended rally would be nothing out of the ordinary. Looking back over the Hang Seng's entire 44-year history implies the chance it will make such a rapid gain is as great as 1 in 3.

As the first chart below shows, the last occasion it did so was between October 2008 and April 2011, when the index rose by 121 per cent. Before that, between April 2005 and October 2007 it surged by 132 per cent.