Monitor | Illuminating confessions from a shadow banker

Finance veteran lifts the lid on a murky world where conflicts of interest and corruption collide, producing a credit bubble ripe for a global crisis

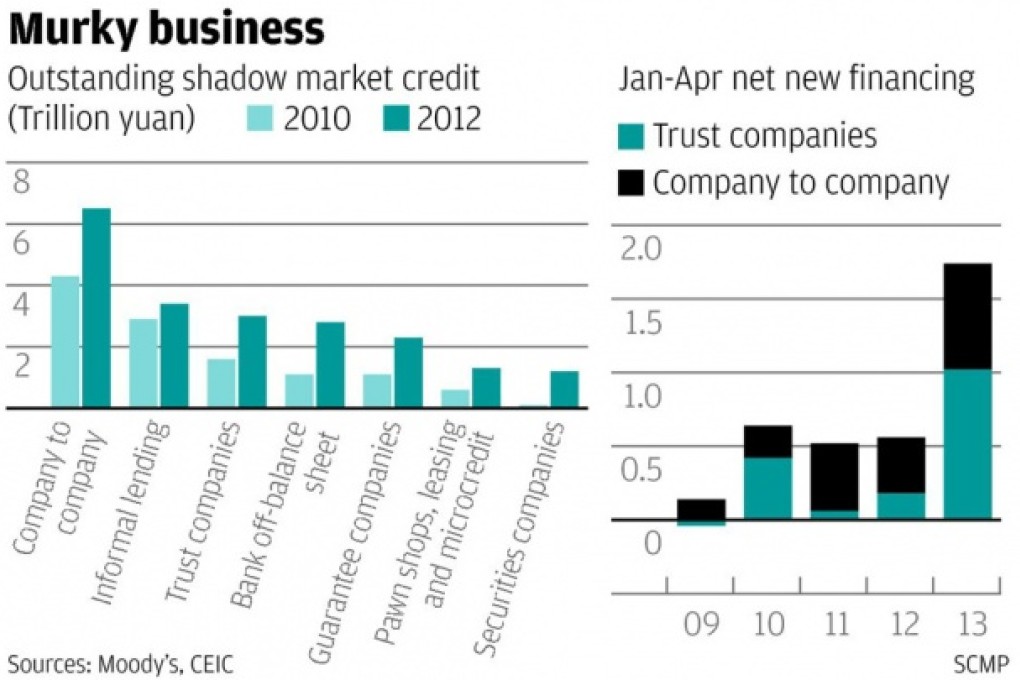

Everyone knows China's shadow banking market is big. According to the ratings agency Moody's, the shadow market was worth 20.5 trillion yuan (HK$25.9 trillion) at the end of last year, or 39 per cent of China's gross domestic product.

And everyone accepts it is growing fast. Even a narrowly conservative estimate indicates the sector grew by 1.9 trillion yuan over the first four months of this year to reach at least 22.4 trillion yuan at the end of April.

But beyond that the consensus breaks down. No one seems able to agree whether the rapid growth of shadow financing threatens the stability of China's formal banking system, nor whether a crisis in the shadow market could endanger the future development of the Chinese economy itself.

This disagreement isn't too surprising. By definition, shadow banking is a murky business, opaque to outsiders and often poorly understood by its own participants.

One person who is uniquely well placed to understand what is going on, however, is Joe Zhang. Zhang is probably best known in Hong Kong as the UBS analyst who back in 2001 triggered the collapse of agricultural giant Euro-Asia, whose chairman Yang Bin later eventually ended up in prison.