Monitor | After a stellar start, Japan's 'Abenomics' faces dim future

Shinzo Abe is popular now, but he still has to steer his fiscal programme through to a successful conclusion and pull off structural reforms

Shinzo Abe may not have made many friends among his North Asian neighbours lately, but to international investors the Japanese prime minister is a star.

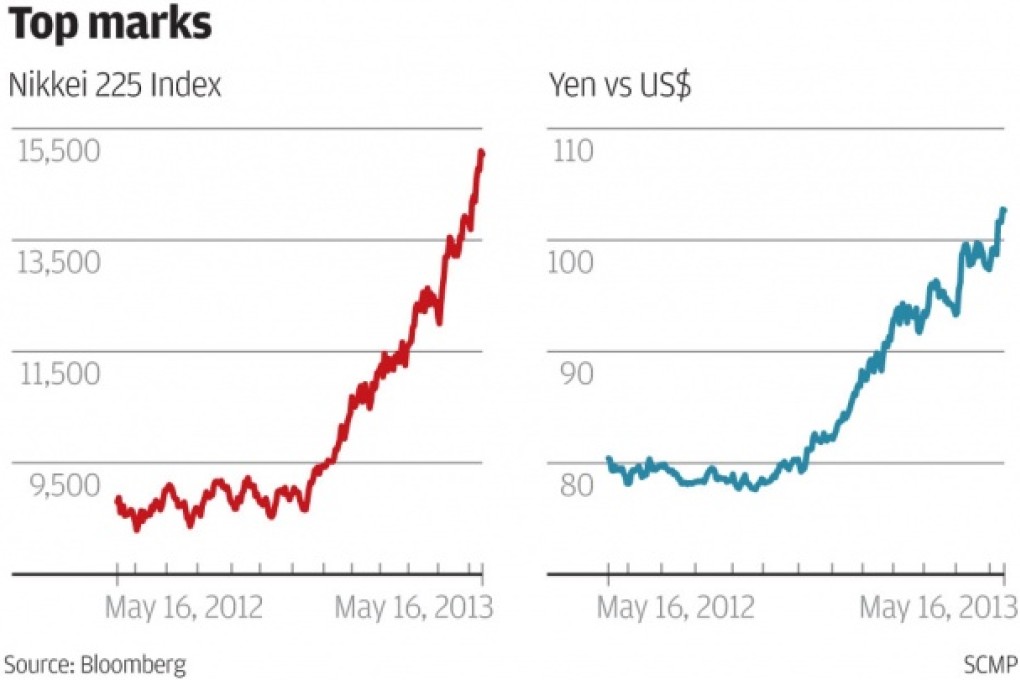

In the six months since Abe emerged as the likely winner of last December's election, Japan's Nikkei 225 stock index has soared by 74 per cent, easily beating the rest of the world's major markets.

Then yesterday, Tokyo announced that Japan's economy grew by 0.9 per cent in the first quarter of the year.

That might not sound like much, but it translates into an annualised 3.5 per cent rate, which is well above Japan's 20-year average of 0.9 per cent and fast enough to make Japan the fastest growing of all the world's major developed economies.

Even better, by far the biggest contributor to the first quarter's growth came from consumer spending; evidence to many that the prime minister's pledge to revitalise Japan's ailing economy with his radical "Abenomics" policy package is working.

Abenomics is a bow with three arrows: monetary policy, fiscal policy and structural reform. So far it is the monetary arrow that has attracted all the attention, after the Bank of Japan pledged to double Japan's monetary base, in an attempt to lift the economy out of deflation and hit its 2 per cent inflation target by the end of next year. The impact has been dramatic. Over the past six months the yen has plunged 23 per cent against the US dollar, and a touch more against the yuan and the euro.