Monitor | Impact of Beijing's anti-sleaze campaign wildly exaggerated

Mainland slowdown is less to do with wary officials cutting lavish spending and more, among other things, with a sluggish homes market

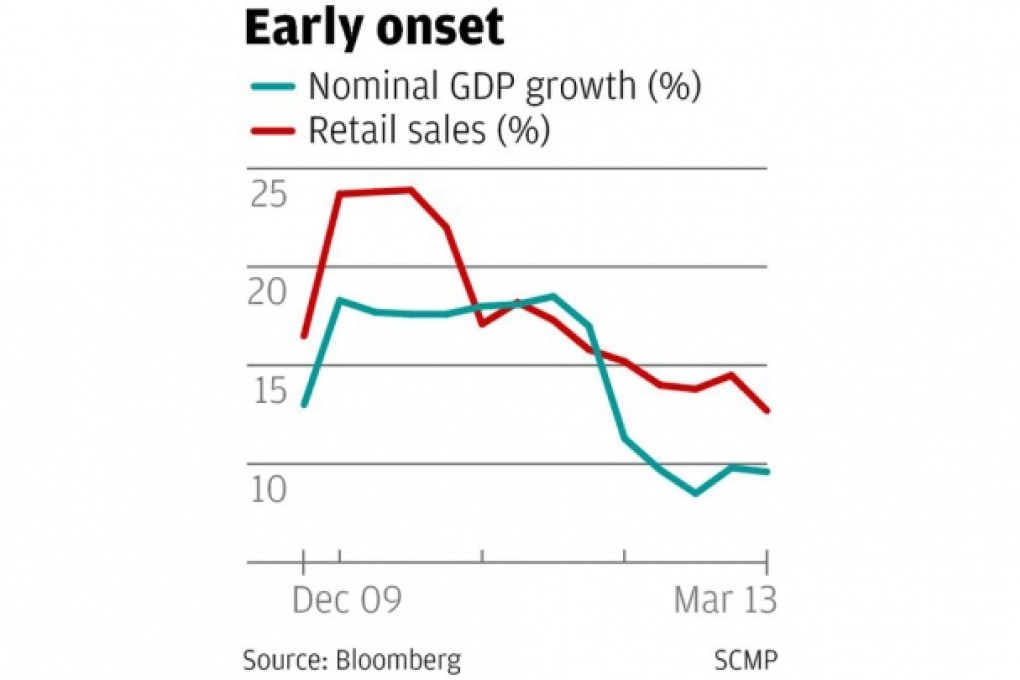

Over the past couple of months, the media have been full of articles about how Beijing's latest anti-corruption campaign has dented consumer demand and even contributed to the slowdown in the mainland's overall economic growth.

At first glance, the data seem to support these stories. In the first quarter of 2013, retail sales growth slowed to 12.7 per cent from 14.5 per cent in the last quarter of 2012. And sure enough, real GDP growth was a weak 7.7 per cent.

Still, blaming the corruption crackdown looks excessive.

A cynic would argue that there is more show than substance to Beijing's periodic anti-sleaze campaigns, and that they are a normal element of leadership transitions.

They allow the new party bosses both to demonstrate their popular credentials, and to cement their political position by purging unco-operative officials and replacing them with their own supporters.