Monitor | True size of Beijing's deficit matches Japan's black hole

International Monetary Fund analysis that adds debt of China's local governments to national balance sheet reveals shocking discrepancy

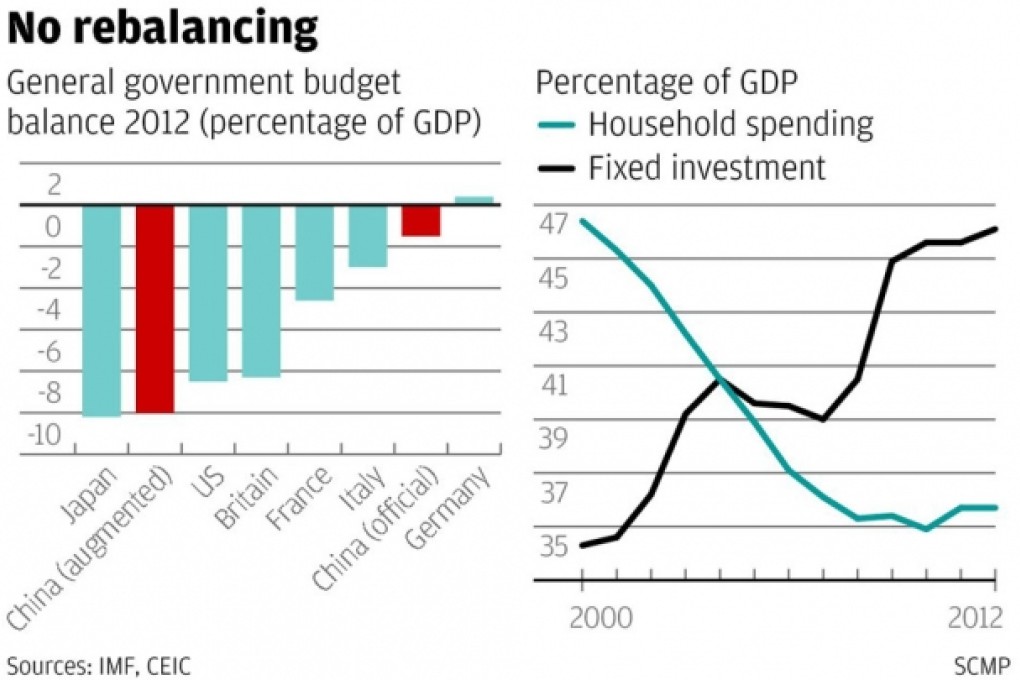

Most analysts, when they look at the economic challenges facing China, end up noting that no matter how daunting the problems, Beijing enjoys a far healthier budget balance than the governments of the world's other major economies.

Unfortunately, the Chinese government's fiscal position may not be quite as enviable as they believe.

At first glance, Beijing's balance looks strong. According to figures from the Ministry of Finance, central and local governments ran a combined budget deficit of 800 billion yuan (HK$1 trillion) last year. For a country that boasted an economic output of 52 trillion yuan in 2012, that equates to a government deficit of just 1.5 per cent of gross domestic product.

That's well below the 3 per cent of GDP level regarded as prudent. And compared to the budget deficits run last year by Japan and the United States, it looks positively insignificant.

What's more, with tax revenues at a relatively modest 19 per cent of GDP, the official figures imply that Beijing has plenty of leeway to boost its revenue collection to plug any emerging budget gaps and to fund future spending.