The yuan hasn't overtaken the HK$ quite yet, Mr Chan

The HKMA boss isn't comparing apples with apples in his claims for the value of interbank payments through Hong Kong's settlement systems

According to the Hong Kong Monetary Authority the yuan has now overtaken the Hong Kong dollar in Hong Kong itself.

Monday's edition of the quoted the boss of the HKMA, Norman Chan Tak-lam, proclaiming that in May the value of yuan interbank payments cleared through Hong Kong's real-time gross settlement system, or RTGS, surpassed the value of Hong Kong dollar payments for the first time.

The average daily value of yuan payments hit 390 billion yuan, he said, while local currency payments were worth HK$487 billion, equivalent to just 384 billion yuan.

A clear demonstration of how the yuan is displacing the Hong Kong dollar, you might think.

Except that the figures for settlement volumes from Hong Kong Interbank Clearing Ltd, the company that operates the system, tell a different story.

According to HKICL, last month it settled yuan interbank transactions worth 7.2 trillion yuan. That works out to an average daily volume of 342 billion yuan, considerably less than Chan's 390 billion yuan.

The HKMA accounts for the discrepancy by explaining that some transactions settled by Bank of China (Hong Kong), the People's Bank of China's yuan clearing bank in the territory, take place outside the real-time gross settlement system.

But if we include yuan interbank transactions not captured by the real-time gross settlement system, we should do the same for the HK dollar.

That means including interbank payments generated by autopay, the securities settlement system operated by the stock exchange, electronic point of sale transactions, and old-fashioned paper cheques.

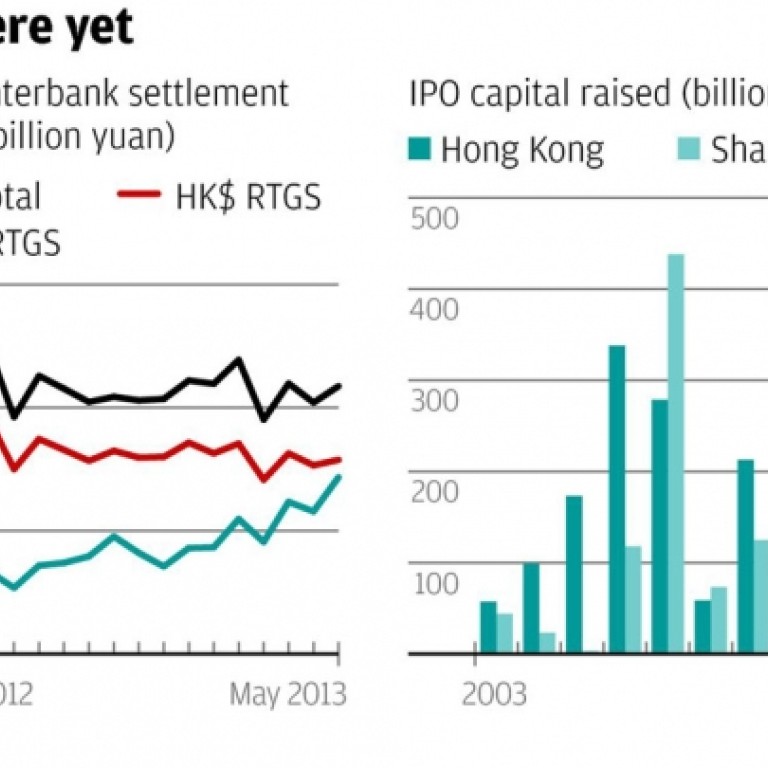

Add those in, and as the chart shows, total Hong Kong dollar interbank settlements in May came to HK$13.7 trillion.

That equates to an average daily volume of HK$654 billion. In yuan terms, that's Hong Kong dollar interbank volumes of 516 billion yuan a day - or one third bigger than Chan's 390 billion a day figure for yuan settlements.

Admittedly, as the first chart shows, yuan settlement volumes are growing quickly, and look likely to overtake Hong Kong dollar volumes at some point over the coming months.

They just haven't got there yet.

Hong Kong detractor lands key Beijing role" announced the front page of yesterday's .

The story related how one Fang Xinghai, "who once famously downplayed Hong Kong's importance as a financial hub", has landed a job with the communist party's top financial policy committee.

I remember one famous slagging Fang gave Hong Kong. It was at a World Economic Forum bash back in October 2001. Fang, then assistant president of the Shanghai Stock Exchange, told Hong Kong it had little hope of establishing itself as a financial centre for the mainland. Hong Kongers didn't have the right connections in Beijing, he explained. What's more, unlike Shanghai, Hong Kong didn't contribute tax revenues to the central government, so the city could expect to win no favours.

However, Hong Kong did have something to offer the mainland, he admitted: "Hong Kong has Disneyland."

Well in a couple of years Shanghai will have a Disneyland too. What it won't have any time soon, however, is fully functioning and reliable financial markets.

As the second chart shows, despite Fang's warning, in eight out of the past 10 years Hong Kong has succeeded in raising more equity capital through initial public offerings than Shanghai (which has been closed to new issues for the past nine months).

Despite what Fang would like to believe, it's not party committees that create successful financial markets.

It's trust.