Mainland China squeeze is bad news for Hong Kong banking system

A surge in loan demand from mainland companies may be on its way - and that could pose increasing risks for the city's financial institutions

The Federal Reserve-induced rout in international financial markets yesterday largely obscured another indicator of mounting stress; one that could pose a major risk to Hong Kong's financial system.

On the mainland, a tightening liquidity squeeze pushed interbank interest rates up to unprecedented highs. At one point the closely followed overnight repo rate surged to 25 per cent, up from 3 per cent just a few weeks ago.

At the same time the three-month interbank rate, which has more implications for borrowing costs in the real economy, climbed to 6 per cent, from less than 4 per cent two weeks ago.

A clutch of factors have contributed to this sudden squeeze. As has become clear, China's economy is slowing, and hot money has begun to flow out of the financial system, reducing the available liquidity. Meanwhile, window dressing ahead of the end of the quarter next week has triggered a scramble for funds.

But above all, interbank rates have shot up because the central bank has refrained from injecting cash into the system to relieve the gathering squeeze.

This lack of remedial action indicates that the authorities are comfortable with higher interbank rates, at least in the near term. Spooked by the recent rapid increase in outstanding credit, which has shot up to more than 200 per cent of China's GDP, it is likely the central bank has sanctioned an increase in interbank interest rates as a warning to the financial system to rein itself in.

However, such a vicious squeeze could have unintended consequences. Shadow market lenders are now prohibited from pooling the money they raise selling so-called wealth management products, which means they can no longer use the proceeds of new sales to repay holders of maturing products.

As a result, many have been forced to turn to the interbank market to cover a rash of product expiries at the end of the month. With interbank rates hitting record highs, stresses in the shadow market are mounting, and analysts warn some issuers could have trouble paying back their investors.

That will be bad enough, but if the squeeze is prolonged after the month's end, as some observers believe it will be, the impact will begin to be felt more in Hong Kong's financial system.

The squeeze has already pushed yuan interest rates in Hong Kong sharply higher, dampening the appetite for issuing yuan "dim sum" bonds in the city's offshore market.

But if it goes on much longer, the squeeze will push corporate borrowing costs up on the mainland. That will generate even more interest among Chinese companies for borrowing in either Hong Kong dollars or US dollars from Hong Kong banks and repatriating the proceeds for use onshore.

The arithmetic is compelling. HSBC's prime lending rate is 5 per cent, a full percentage point lower than the onshore three-month interbank rate. But a surge in loan demand from mainland companies would pose risks for Hong Kong banks.

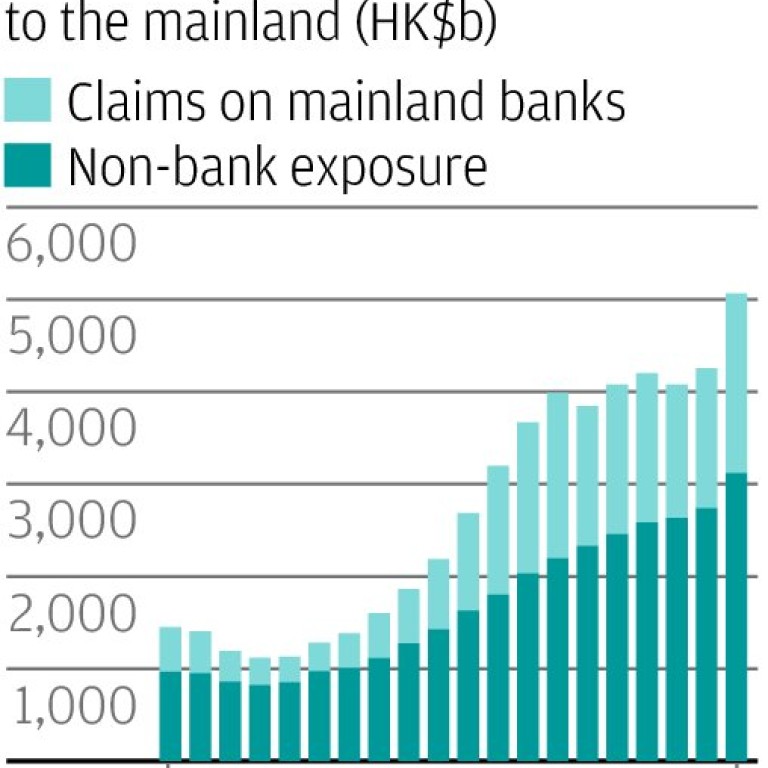

The Hong Kong banking system's exposure to the mainland has risen steeply so far this year. According to the Hong Kong Monetary Authority, between December and March, Hong Kong banks' claims on mainland banks shot up by 28 per cent.

The rise in non-bank exposure has yet to be published, but even though it is likely to considerably slower, the total gross exposure of Hong Kong banks to the mainland is likely to have climbed by almost 20 per cent over the first quarter of the year, to hit HK$5 trillion (see the chart below).

That's a third of the Hong Kong banking system's entire asset base.

In the past, Hong Kong bank lending to mainland borrowers has been reckoned relatively low-risk, with loans well collateralised by onshore deposits.

But the recent rapid increase in exposure has unnerved both regulators and investors. At a conference earlier this week hosted by Fitch Ratings, 63 per cent of the delegates identified exposure to the mainland as the biggest risk currently facing Hong Kong banks, twice as many as were worried about their exposure to the local property market and consumer credit .

With the mainland economy now slowing, and that slowdown sure to put pressure on corporate margins, observers are already nervous about the outlook for Hong Kong banks' asset quality. The current liquidity squeeze will only magnify those concerns.