Monitor | No, it's not 1997, but Asia is still exposed to nasty risks

Some reckon there are enough parallels between financial conditions now and just before the Asian financial crisis to warrant serious concern

Next week doesn't only mark the 16th anniversary of Hong Kong's handover. It is also the 16th anniversary of the Thai baht's devaluation: the moment when a local financial crunch in Bangkok went regional, triggering Asia's catastrophic currency crisis.

That might seem a distant memory, but there are enough parallels between financial conditions now and then to prompt some to ask whether Asia today is on the verge of a similar economic abyss.

In early 1997, as in 2013, Asia's asset markets had been lifted to new highs by an inrushing tide of cheap foreign capital. With confidence in the region's future high and local currencies strong, Asian businesses borrowed enthusiastically to fund evermore ambitious investment projects, many of them in fast-rising local property markets.

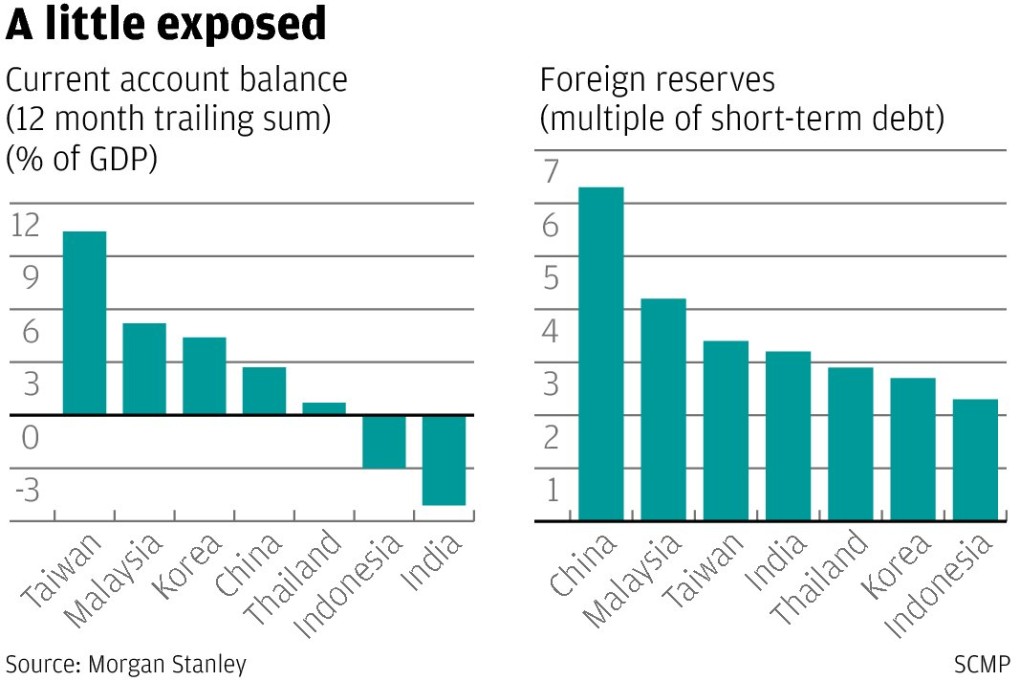

Then, as now, debt levels rose sharply and current account balances deteriorated, even as in Hong Kong home prices surged to a record high.

Then things started to go wrong. With the US Federal Reserve adopting an increasingly hawkish stance, international liquidity conditions began to tighten.