Monitor | Despite rebalancing, exports still vitally important to China

A more precise measure of external demand reinforces the scale of its contribution to growth, and that's why a lot hinges on trade numbers

Tomorrow Beijing will release China's trade figures for June.

The outlook is grim. After exports grew by less than 1 per cent in May - a far cry from the 20 per cent growth rates China was recording just two years ago - analysts are forecasting another lacklustre performance.

Confronted with weak external demand, especially from recession-hit Europe, it seems China's formidable export machine has stalled.

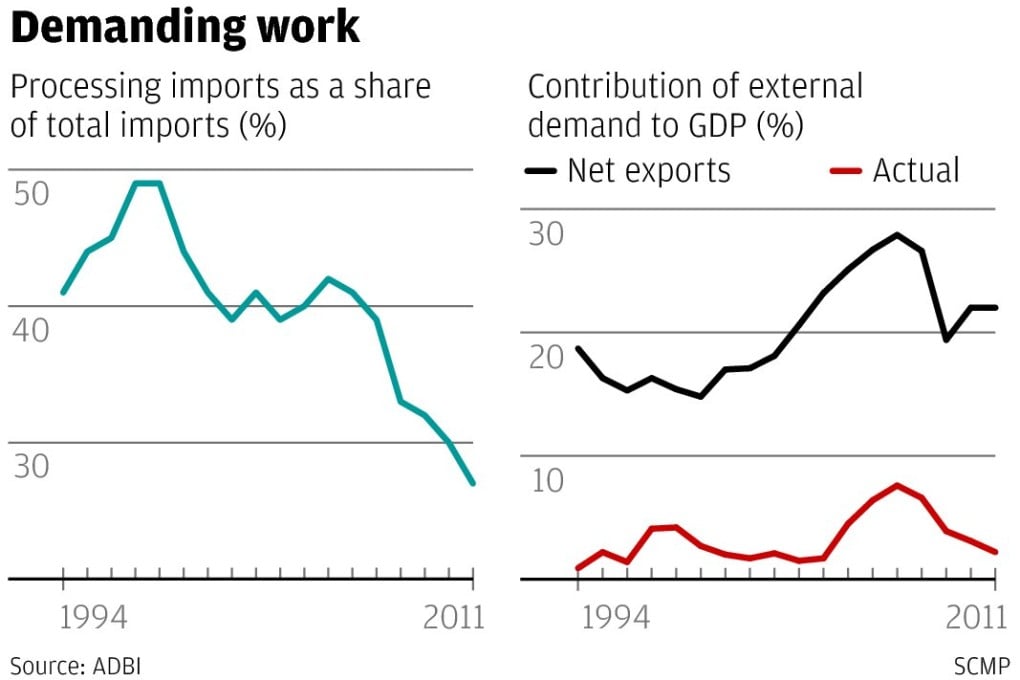

Yet most China-watchers are untroubled. These days, they explain, China's economy is all about investment and domestic demand. Exports now make up only a tiny share of China's gross domestic product, and they contribute even less to economic growth.

That might sound like a strange thing to say, given that in the first quarter of this year China's export shipments were worth an impressive 27 per cent of the country's GDP.