Monitor | It's time for some big thinking about Hong Kong's tax system

With the prospect of shrinking revenue ahead, this column will get the debate started with some inventive – and fair – options to fill the coffers

Whenever organisations like the World Bank, the Heritage Foundation or the World Economic Forum compile their league tables of global competitiveness, Hong Kong always draws fulsome praise for its low and simple tax regime.

With its salaries tax capped at just 15 per cent, a profits tax of 16.5 per cent, and no dividend, capital gains or goods and services taxes, the city is typically ranked only behind the oil-rich states of the Persian Gulf for the attractiveness of its tax regime.

They know the territory can only operate such a lenient tax regime because the government relies for so much of its revenues on the city's property market.

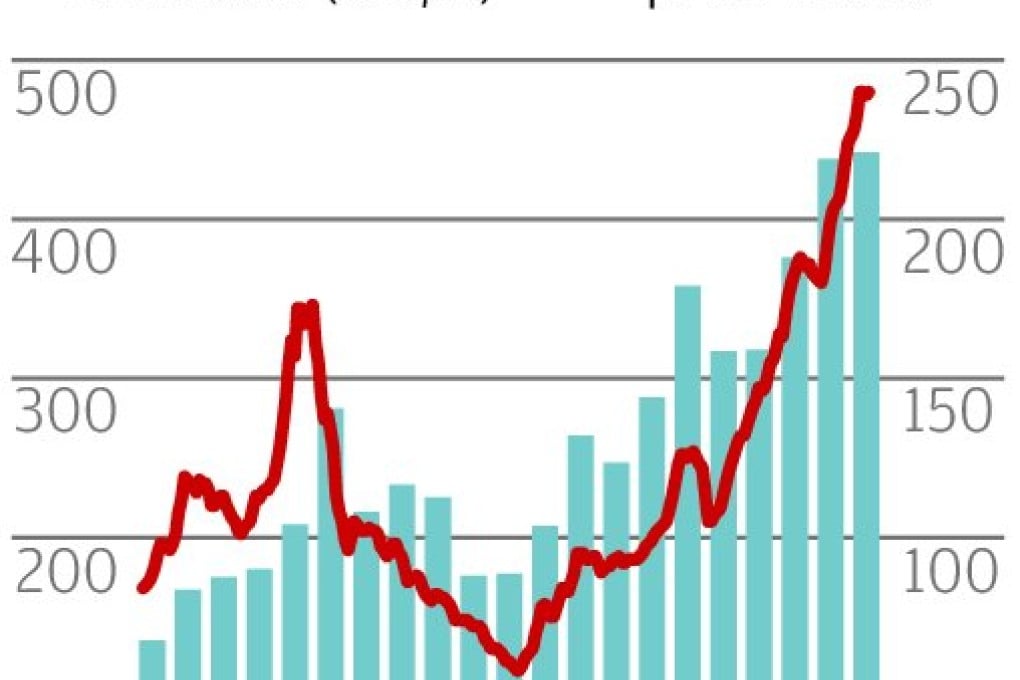

Income from land sales, land premium - the fees developers pay for a change in land use - property rates and stamp duty on real estate deals together make up around 25 per cent of the government's revenues.

Add in the profits tax paid by developers and the salaries tax levied on their employees, and the contribution of the property sector to the government's coffers climbs to somewhere near 50 per cent.