Monitor | True level of bad loans is far higher than Beijing admits

While no one believes official line, no amount of statistical flexibility will ease the impact when problems mount in tandem with slowing economy

When Chinese regulators said earlier this week that non-performing loans on the mainland amount to less than 1 per cent of total bank lending, no one believed a word they said.

Officially, mainland banks' asset quality is super-solid. At the end of June, the value of commercial bank loans classed as sub-standard, doubtful or in loss came to 540 billion yuan (HK$678.9 billion).

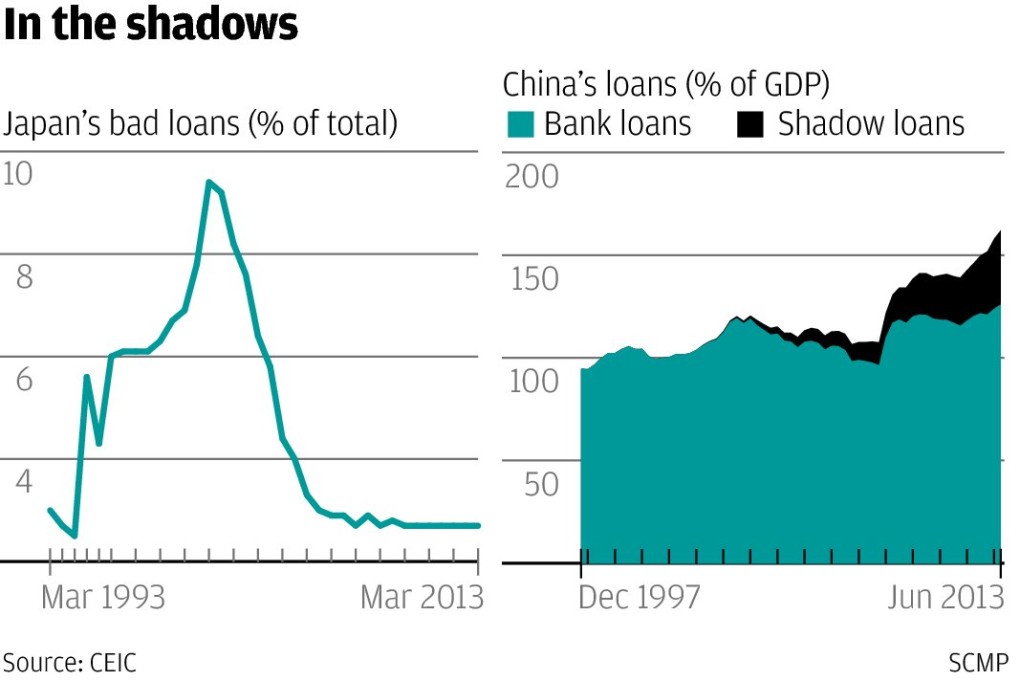

That means just 0.7 per cent of Chinese banks' local and foreign currency loan books is deemed to be non-performing. In comparison, the ratio in Japan is 2.9 per cent.

Rolling over loans to zombie firms crowds more productive borrowers out of the market

In any case, according to their financial statements, Chinese banks have made ample provisions against loan losses, setting aside almost 1.6 trillion yuan, enough to cover their current bad loans nearly three times over.

The trouble is no one believes the official figures are an accurate guide to Chinese banks' asset quality.

If a state sector banker lends 10 billion yuan to a local government-owned aluminium smelter for three years, and at the end of that time the company is unable to pay him back, he just lends another 10 billion yuan so it can repay the original loan. That way no one gets embarrassed by any non-performing loans.

With little reliable information about bank credit procedures or the quality of their loan books, working out just how many loans would now be classed as non-performing had they not been rolled over in this fashion is impossible.

However, given that China's total outstanding loans have more than doubled in value since 2008, it is simply not credible that bad loans should have fallen by 20 billion yuan over the same period.