Monitor | Two ways currency experts are wrong about the yuan

In contrast to analysts' views, China's currency is actually sharply overvalued in real terms. Nor is Beijing loosening its capital controls

Ask currency analysts about the yuan, and the chances are they will tell you two things.

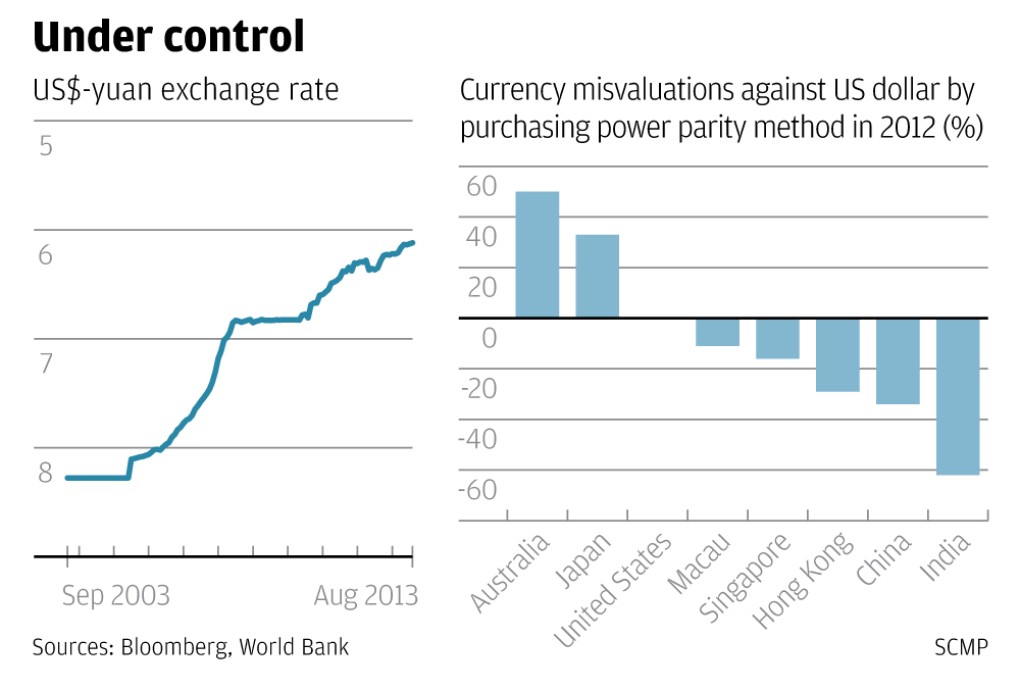

First, they will say that despite appreciating 35 per cent against the US dollar over the past eight years, China's currency is still undervalued.

Second, they will tell you that in their determination to internationalise the yuan, policymakers in Beijing have been busy dismantling China's remaining capital controls, and that for most intents and purposes, the currency is now freely convertible.

They are wrong on both counts.

Working out what a currency's fair value should be is notoriously tricky. The most common method economists use is to say commoditised products - like a can of Coca-Cola or a Big Mac hamburger - should cost the same in every country. Then they see how much market exchange rates deviate from this reference price.