Crux of Hong Kong's pricey homes lies with Fed policies

We may end up overbuilding by wrongly attributing high housing prices to shortages

You have to laugh. The long-term housing strategy steering committee had already so thoroughly leaked and trial-ballooned its proposals that by the time it actually published them, there was nothing left to say but why they wouldn't work.

It's just as well. This consultation paper is mostly a political document, long on the slogans and ideology of the public housing lobby but somewhat shorter on detailed statistical analysis.

For instance, it baldly proclaims that "the crux of our housing problem lies with supply-demand imbalance".

How good to know. We have it defined then, which is something I have sought ever since a policy address two years ago in which our previous chief executive cited figures showing that we have 250,000 more flats in our housing stock than we have households. He must have got that wrong, said his underlings privately. I never saw it set right.

And I still don't, not from this latest study anyway. How big is the gap between supply and demand precisely? No answer. How much has this changed over the years? No answer. By how much is it getting better or worse? No answer.

Let me try a rough sketch of it. Although the official figures contain some puzzling anomalies, take the number of households in Hong Kong and divide this by the number of flats in the housing stock. You now have something called the household sharing ratio, the proportion of households forced to share a flat with other households.

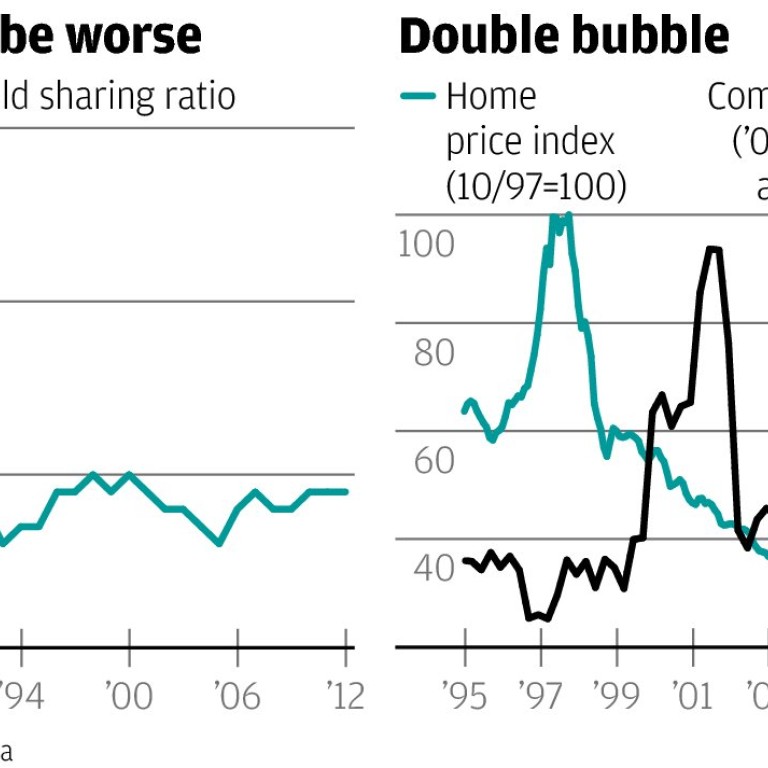

This is the best real measure of overcrowding. As the first chart shows, the latest ratio is 1.09, pretty much what it has been for the past 15 years. Overcrowding is not by far as bad now as it was in the mid-1980s.

Where the consultation paper has gone off the mark is in its supposed crux. The real crux of our housing problem is price. Home prices have launched themselves to the orbit of the moon, which is a phenomenon that, yes indeed, commonly results from a supply-demand imbalance, but not in this case.

In this case, it results from the monetary policies of the US Federal Reserve Board, which for a number of years has kept interest rates artificially low to stimulate the economy.

Because of our peg to the US dollar, it has also stimulated our economy, in fact over-stimulated it by pushing up the prices of those investment assets that are most sensitive to interest rate levels. Nothing is quite as sensitive to them as property.

The danger of wrongly attributing our high housing prices to shortages, as our housing strategy committee has done, is that we may now be induced to overbuild housing. The last time we did this we got what the second chart shows, a supply bubble four years after a price bubble and a price collapse made much worse as a result.

Let's not do it again.