Asia can relax; there is small chance of a US debt default

Washington will have no problem repaying its loans, given the tax revenues it will be getting and its ability to roll over maturing debt

In these divided days, it might seem that nothing can bring the leaders of China and Japan together.

But American politicians have achieved the near-impossible. Washington's budgetary brinksmanship has finally got the uneasy Asian neighbours seeing eye to eye.

On Monday, Vice-Finance Minister Zhu Guangyao said that as a major holder of US government bonds, Beijing was "naturally concerned about developments", and called on Washington "to ensure the safety of Chinese investments".

Then on Tuesday, Japanese Finance Minister Taro Aso weighed in, warning that a continued political stand-off would undermine the value of Japan's holdings of US debt.

Their nervousness is hardly surprising, given the rhetoric coming out of Washington and the tone of much of the media coverage.

In the past few days, John Boehner, Republican leader in the House of Representatives, has accused President Barack Obama of "risking default", while Obama has slammed the Republicans for threatening "economic catastrophe".

At the same time, financial news service Bloomberg has warned the US government is just weeks away from a default, "an economic calamity like none the world has ever seen".

Happily for Zhu and Aso, both the political rhetoric and the media hysteria are monstrously overblown. There is almost no chance at all that the United States will default on its debt.

The week-old partial shutdown of the US government following the failure of Congress to approve next year's budget is relatively unimportant. It is the 15th such shutdown of recent decades. None has had a lasting effect.

The prospect that Congress will fail to raise the US government's debt ceiling before the Treasury hits its borrowing limit in the middle of this month is more serious.

If there is no deal, the Treasury will have to restrict its spending to no more than it earns in tax revenue. That could mean late payments for government contractors and social security claimants.

But considering that the Treasury will still be taking in between US$10 billion and US$15 billion a day in tax revenues, it will have no problem making debt interest payments of US$51 billion due between now and the end of the year. And with the government permitted to roll over maturing debt, Washington should have no difficulty in meeting principal repayments.

So the Chinese and Japanese governments can both relax and get back to squabbling with each other.

Wishful thinking prize of the year must surely go to President Xi Jinping, who declared on Monday that "the slowdown of the Chinese economy is an intended result of our own regulatory initiatives".

Like heck it is. Over the past 18 months, mainland leaders have done their utmost to keep growth afloat, encouraging the financial system to pump out new credit at a breakneck pace to fund a massive investment programme.

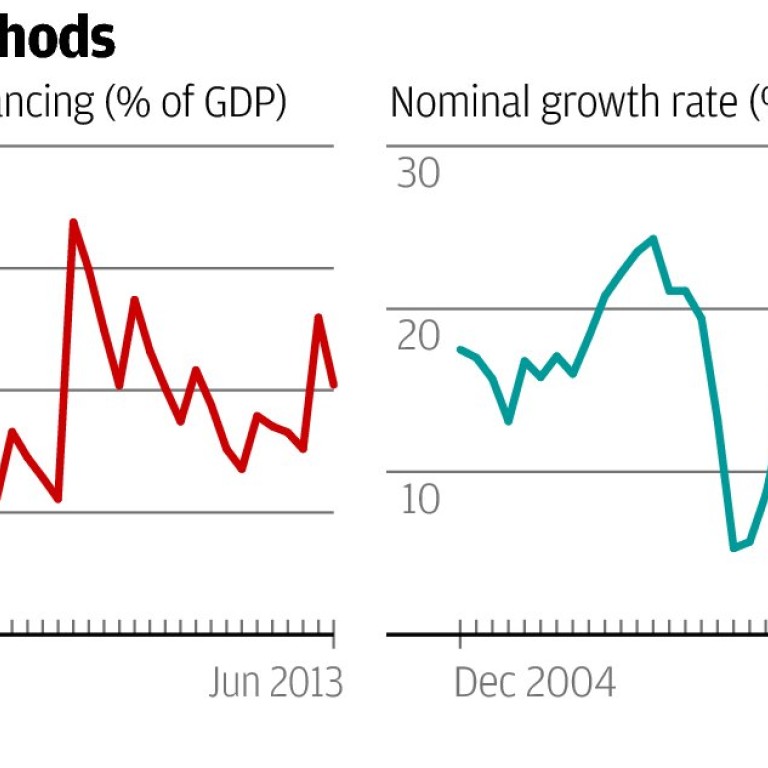

Since the beginning of last year, the country's broad "total social financing" measure of new funding has consistently exceeded 30 per cent of gross domestic product, a level only before seen in Beijing's all-out stimulus programme during the financial crisis.

The attempt has failed. All that investment has created a glut of industrial overcapacity that has pushed much of the economy into deflation and ensured that further credit-fuelled capital expenditure would gain little economic traction.

As a result, growth has slumped, with the mainland's nominal growth - that is before Beijing's dodgy adjustments for inflation - collapsing from an 18.5 per cent rate in the third quarter of 2011 to just 8 per cent in the second quarter of this year.

If that slowdown really is the result of a deliberate policy, it certainly represents a novel way to rein in runaway economic growth.