Monitor | The US$50b a year reason China's elite love tax havens

Taking the money out is just the first step; it's all about sending it back under the guise of foreign investment and enjoying the taxman’s largesse

Yesterday an outfit called the International Consortium of Investigative Journalists published a story in several newspapers around the world alleging that close relatives of many of China's senior leaders own companies registered in offshore tax havens including the British Virgin Islands.

In terms of revelatory shock, this story has as much news value as the pope's catholicism.

Nonetheless, it is interesting - although scarcely surprising - to read that Xi Jinping's brother-in-law, Wen Jiabao's son, Li Peng's daughter and Deng Xiaoping's son-in-law, among others, all have ties to companies in jurisdictions like the BVI with minimal disclosure and no corporate taxes.

However, beyond saying that tax haven secrecy laws allow companies "to hide and facilitate all manner of crimes and abuses", and quoting vague estimates of massive illicit fund flows out of China, the article was unclear about exactly why China's princelings would want to set up offshore companies.

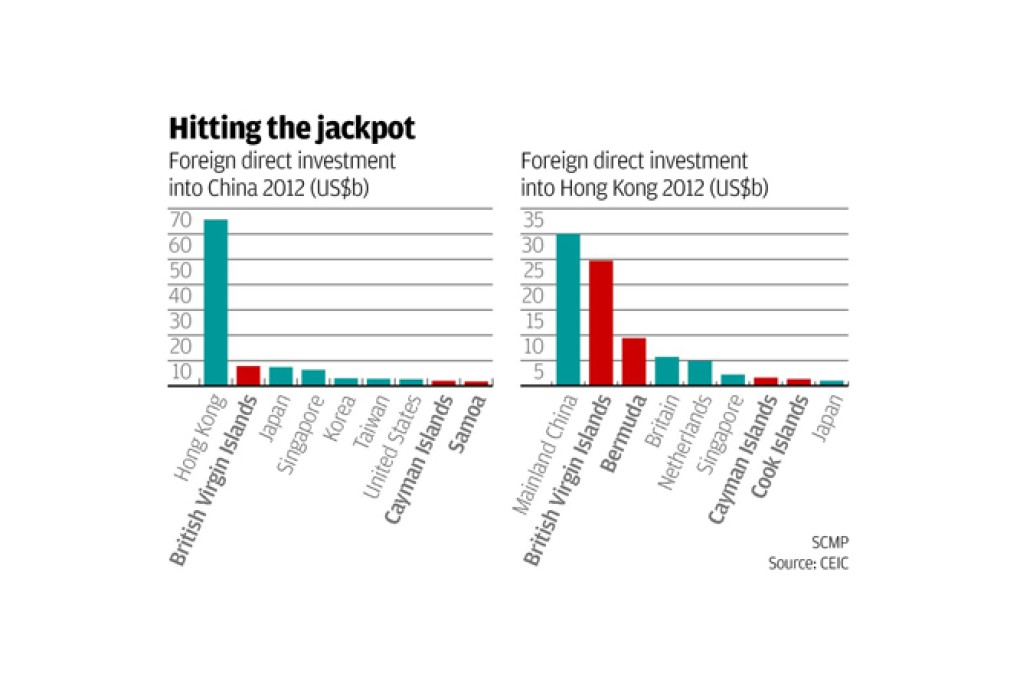

The explanation is not so much that they want to siphon money out of China, rather that they want to channel it in again.

Like the rich everywhere, China's wealthy dislike disclosing the value of their assets and handing over money to the taxman, especially if they made their fortunes trading on the influence of their high-ranking relations.