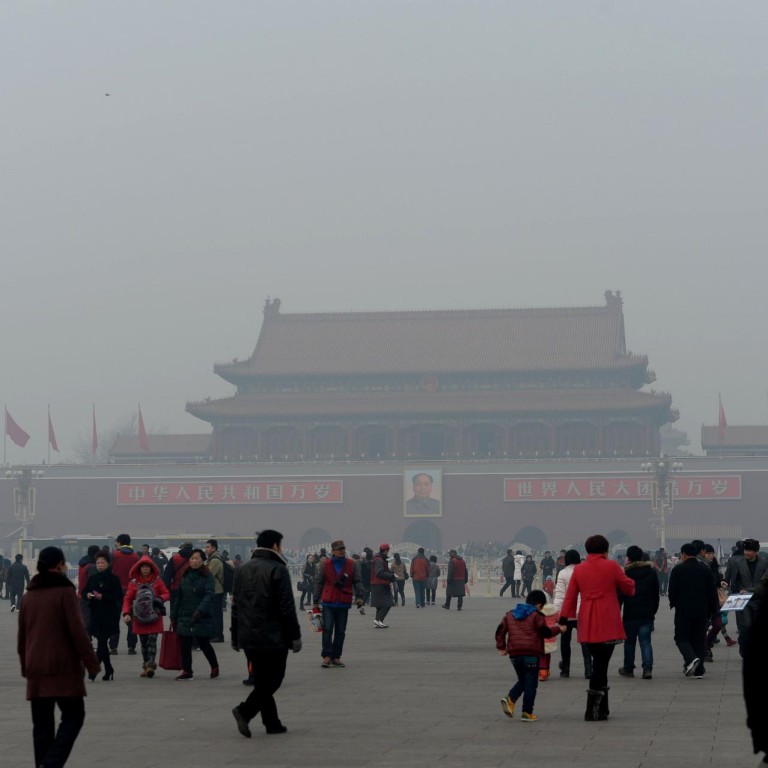

Why does the global warming debate generate such hot air?

One of the interesting aspects about the global warming discussions that we indulge in here from time to time, is the nature of the response they generate. They seem to generate a lot of heat and most of it is personal: Responses mostly from those that appear to accept the orthodox views on the matter, that is, the view disseminated by the UN Intergovernmental Panel on Climate Change, that science shows that global warming is happening and that at least half of it is supposed to be due to man's activity in the form of the production of C02. The emotion and anger that the subject generates is surprising not just here, but on the science threads that can be found on the internet. Why is it that anyone offering views that differ from received global warming orthodoxy, generates such heat? Most unscientific.

Bumbling bureaucracy mars bars seating arrangements

We hear of more strange tales of the curious bureaucracy surrounding licensed bars.

People will be familiar with the bars at the China Resources Building in Wan Chai. One of the features of these bars is that the building was designed to create an overhang to facilitate outdoor seating, an arrangement for which China Resources is understood to pay the Lands Department a sum believed to be about HK$2 million.

Early last year China Resources closed the bars and tidied up the area, before the bars were invited back. However things were not as before, and the bar owners discovered to their dismay that the Buildings Department would not now permit outside seating. After some time trying to rectify the situation, a grand meeting of all affected parties was convened, which included the government departments concerned.

After introductory remarks the bar owners' representative was poised to make the case for the bars when he was interrupted by a man from the Buildings Department. To the astonishment of the bar owners he said it appeared that the bars had been ill-advised and had not submitted their forms requesting outside seating correctly. All they had to do was to resubmit and permission would be forthcoming.

People were dumbfounded that it had taken a meeting to establish this mundane fact but nevertheless went ahead and resubmitted.

However those expecting an early resolution were disappointed. It took the Buildings Department an astonishing seven months to give its permission. So much for the Hong Kong can do spirit.

The public relations company Bite Global has been very persistent in attempting to lure us to one of its client's events. It turns out that the Hong Kong owned factory, Guangzhou Daming United Rubber Products, produces a range of condoms under the Aoni brand name. To its credit it has achieved a Guinness World Record in producing the world's thinnest latex condom at 0.036mm. To further our understanding of the product we've been invited to a "live presentation". This, it turns out, involves a chat with the factory's managing director, Victor Chan, "and sharing provocative insights and dispelling myths about sex and love."

Intriguingly the invitation goes on to say that we will able to view Aoni's entire range "To cater for different occasions and individual preferences." Not to be missed.

Asian hedge funds could be in for a good year at least with respect to attracting new funds. More than 50 new funds have started in the region this year, according to the website . The new funds, according to the website, are bigger as investors aggressively add exposure to Asian funds.

Asian hedge funds saw a record inflow of US$4.2billion in the fourth quarter of last year. All told, the industry ran US$112.3billion as of December 2013, which is also a record. But the hedge fund boom is not just occurring in Asia. Research by Deutsche Bank shows investors may triple the capital they invest in hedge funds this year, according to Bloomberg.

Hedge funds may attract US$171 billion of net inflows and generate US$191 billion in performance-related gains, according to 413 investors globally with US$1.8 trillion of industry assets polled by Deutsche in December. The combined effect will help boost assets by 14 per cent to US$3 trillion by year-end.

Have you got any stories that Lai See should know about? E-mail them to [email protected]