New | Will the Rmb pop the property bubble?

The Rmb has reached its equilibrium; currency volatility will spill. In a bold move, the PBoC announced to double the Rmb trading band from 1 per cent to 2 per cent. This is a historic moment. Yet at the time of the Crimean referendum and after a few weeks of currency gyration, the reception to this significant announcement in the domestic market is somewhat underwhelming. Consensus discussions have been centred on what such a move means for monetary policy manoeuvres at a later date. Yet parsing through the PBOC’s scripted press response, we think there is much more than meets the eyes.

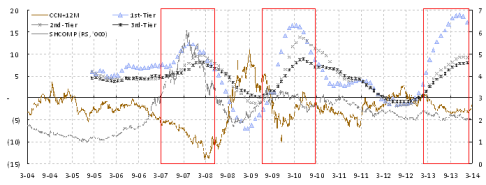

In the PBOC press release, it states that the ratio of current account surplus to GDP has decreased to 2.1 per cent and thus is not a strong basis for further Rmb appreciation. Meanwhile, China’s sufficient forex fund holding means little basis for Rmb deprecation. In short, the Rmb has somehow reached its equilibrium, according to the PBOC. Incidentally, this statement is consistent with the peak in China’s productivity growth. If such an interpretation is correct, the secular Rmb appreciation that started from the exchange rate reform in July 2005 has finally come to an end. Given that a 2 per cent single-day move is not usual even for a major international currency such as the US dollar or the euro, it would also mean that from now on, the Rmb exchange rate will likely be more market driven.

Since late 2012, the Rmb has been consistently appreciating towards the 1 per cent daily limit - until early February when the PBOC intervened with the rampant Rmb carry trades. How the market interprets this message remains to be seen. But given that the currency market is very much momentum driven, it is not inconceivable that the Rmb would depreciate close to its daily 2 per cent limit for a period, in a reversal move to undo the one-way trade for more than a year - until the PBOC intervenes again to reset the expectation. One thing I can be sure of is that volatility in the currency market is set to rise, at a time when market expectations are resetting within a trading band that is twice as wide. In a previous column, I wrote about how the offshore yuan, CNH, has priced in significantly more volatility than its onshore counterpart CNY. The market should now get ready for a burst of currency volatility, and a potential spillover.

Some pundits are starting to fancy about a RRR, and even an interest rate cut. I do not necessarily disagree. Yet the significance of such a move is offset by tighter monetary conditions due to a decline in forex fund holding. Further, the economic slowdown versus expectations is one of the most dramatic since the 4th quarter of 2008. Such developments do tend to invite government intervention historically, if not engineered on purpose. But right now, employment is full, with some areas even reporting labour shortages, and money is not tight. With the rise of Chinese consumption, the economy can now absorb more labour with less growth. And the government has also declared its emphasis on employment over growth during the recent National People’s Congress sessions in Beijing. It makes an immediate RRR cut less likely. Even if there is one eventually, it is done only to offset a fall in forex fund holding, but cannot change the course of the slowdown.

In the near term, the environment is still not conducive for risk undertaking. Crimea will likely create a standoff between Russia and the uncommitted West. If expectations for an Rmb depreciation set in, they will reverse everything we have seen along its appreciation course, and pop the property bubble. True, Chinese markets have been under selling pressure. But risks have not been fully priced in. And during the selloff of industrial metals, some traders actually added positions to average down. Many iron ore trades are unhedged, and thus exposed to further downside . A transient technical reprieve is difficult for big funds to participate, and as such will remain fleeting. Don’t fall for any dead cat bounce. The worst is yet to come.

The author is managing director for research at Bank of Communications. Follow him on Sina Weibo.