Time for Germany to play as a team and share its powers

To put its economy back on the growth track, Berlin needs to integrate with its partners in the euro zone and loosen its fiscal policy

Germany's growth locomotive has come off the rails again. The latest gross domestic product figures show the economy contracted 0.2 per cent in the second quarter. The odds are that Germany has slipped back into recession, which would mark its third in less than six years.

Germany's "economic miracle" has clearly hit the buffers.

Berlin only has itself to blame for poor economic performance. Its policymaking has prioritised domestic success over the wider well-being of its euro-zone partners. It must become a better team player rather than the leading goal-scorer. Sharing some of its global economic powers would be a start.

Hopes had been high that Germany would power the euro zone out of deflation, high unemployment and debilitating debt. Those hopes have gone up in smoke.

Germany, France and Italy have all succumbed to a sudden downturn in growth prospects.

The French economy is stagnating while Italy is bogged down in recession.

Rising geopolitical risks from the Ukraine crisis, trade sanctions on Russia and the slide towards deflation are all taking their toll on Germany, where inflation has slipped to 0.8 per cent and could soon dip into negative territory. It would be another bad omen for the spirits of a country where economic confidence has been in retreat since the start of the year.

Fallout from the Russian sanctions is already hitting the German economy very hard - and it is not just the 3 per cent of German exports destined for Russia that are at risk. Rising uncertainty means more German firms are likely to shelve output and investment plans. Third-quarter GDP is likely to reveal even deeper damage to the economy.

The impact could be long-lasting as German consumers are unlikely to be in a rush to take up the slack despite the recent upturn in wages and job prospects. German shoppers are perennially cautious and a downturn in the economic and political climate will only act as a bigger incentive to hoard money.

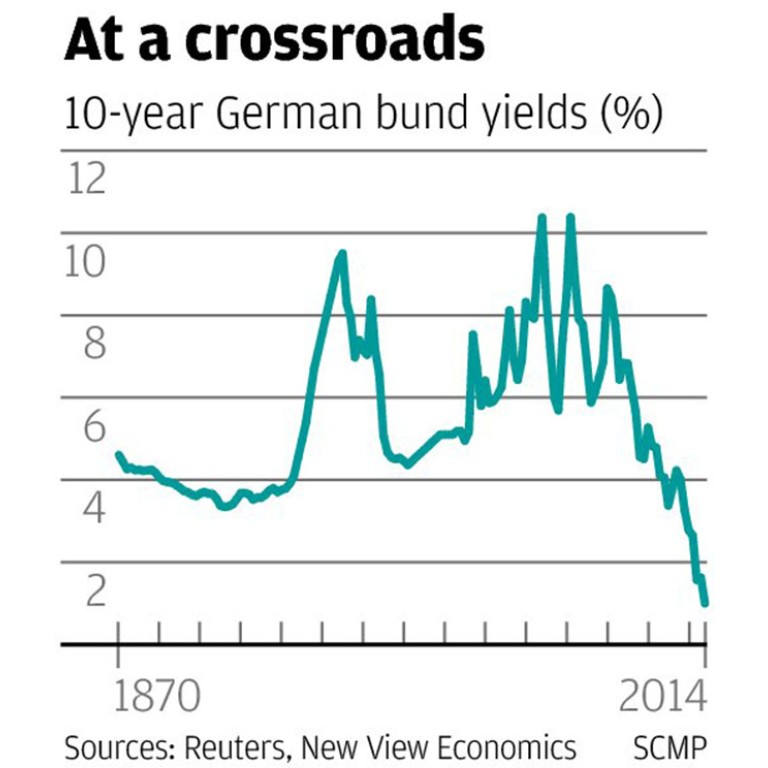

Safe-haven demand for investments like German government bonds has been extreme. With deposit rates stuck close to zero, investors have flooded into the bonds, driving yields to historic lows at about 1 per cent - reminiscent of Japan's "lost decade" when chronic recession and deflation drove government bond yields below 1 per cent.

Germany has reached a crossroads. It is time for a change. National economic self-interest and policy conservatism need to be ditched - and fast.

Die-hard opposition to euro-zone quantitative easing has left the bloc at a severe disadvantage to the United States and Britain.

Its hard line on a strong euro has also been a hindrance to growth. Official benign neglect for a softer euro would have served the interests of faster export-led recovery and been much better for the euro zone as a whole in recent years.

The euro trading 15 to 20 per cent weaker would provide a competitive edge that hard-pressed euro-zone nations really need now.

Germany could also afford to be more generous on domestic policy as the government looks set to balance by next year its budget books for the first time in 45 years - a sign that fiscal policy is too tight.

Easier fiscal policy would help revitalise domestic demand. It would also boost demand for imported goods, benefiting global trade at the same time. It would set a good moral lead as Germany boasts the biggest current account surplus in the industrial world.

But a major stumbling block for fuller euro economic integration has been outright German hostility in the past to key issues such as euro-zone fiscal union and the launch of common euro government bonds.

Had these defences been in place before the financial crisis began five years ago, the euro zone would have been much more resilient to the downturn that followed.

It is time for a radical rethink and new policy action - and not just from euro-zone policymakers. Germany must play a leading role in promoting, rather than resisting, new economic initiatives if the euro zone and the euro are to survive and thrive over the future.

Without sweeping changes, the euro is doomed.