The View | Pulling the strings

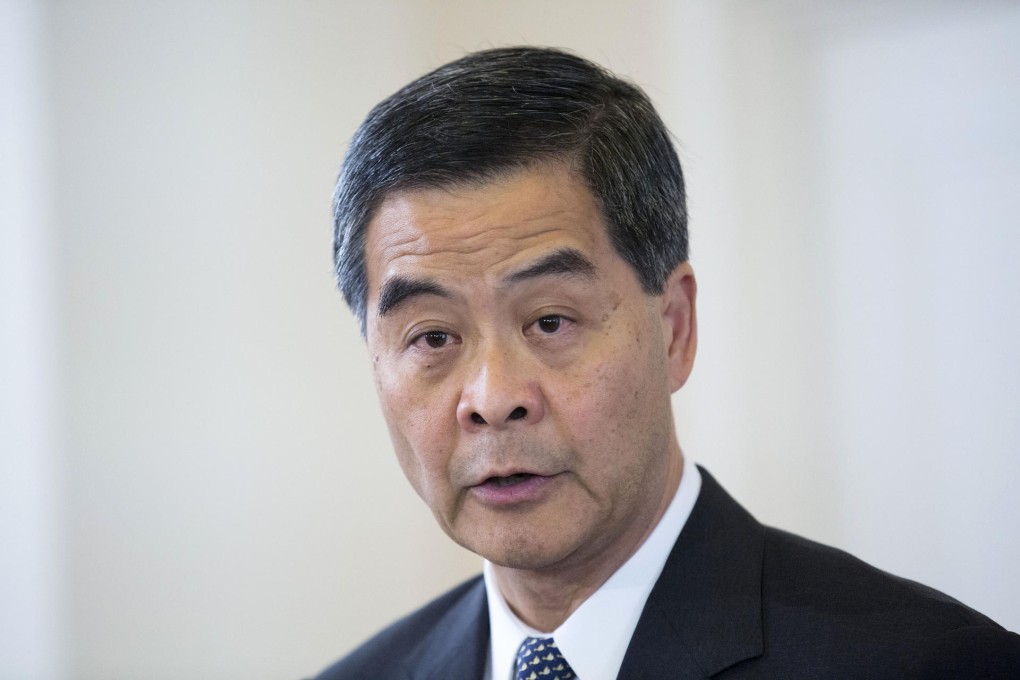

Chief executive's gaffe raises the prospect of the elite perverting legal system to their advantage

In one of the worst political gaffes since US President Clinton protested, "I did not have sexual relations with that woman", Chief Executive CY Leung officially explained the truth behind Hong Kong's business-led governance. According to Leung, the problem of equal representative voting "would be talking to half of the people in Hong Kong who earn less than US$1,800 a month. Then, you would end up with that kind of politics and policies". One assumes he was referring to excessive welfare for the poor rather than the corporate welfare that benefits tycoons today.

But, by doing so he virtually asserts that there is no reason why Hong Kong's oligarchs will give up their control without a struggle. Leung has thrust Hong Kong's business elite into the front line of class warfare. Most of all, Leung's revelations are particular dangerous to the perception of how its government, business and economy operates.

Perception is paramount to maintaining power and prestige. And power is where everyone believes it resides. It's really a trick, a shadow on the wall. By officially opening the curtain and revealing that the city's elite will not trust its citizens to govern, he sets the stage for heightened political and business risks. The students' struggle really isn't against the restrictions of the Basic Law, but tycoons who conspire with Beijing and Hong Kong governments to frustrate democratic development.

Leung's depiction of Hong Kong as a plutocracy run by a group of ultra-high-net-worth families allows us to make cynical comparisons of how their conduct may affect the city's business and financial future. Recent calls by Leung, Li Ka-shing and Tung Chee-hwa for students to restore stability are now seen in the context of Leung's remarks as being hopelessly deluded, duplicitous exhortations that fail to address any problems.

When one thinks of modern cities dominated by powerful and greedy families, some of the most decrepit urban environments come to mind. Consider Newark, New Jersey, run by mafia families for decades.